A strong pre-seed pitch deck highlights the problem, your solution, early validation, market size, team, and a clear funding ask. Investors fund clarity and insight, not traction, so your deck must highlight validation signals and a realistic plan toward product market fit.

Nov 28, 2025, 12:00 AM

Written by:

Niko Ludwig

Table of Contents

Key Takeaways:

Pre-seed investors fund insight, not traction. Strong problem clarity and validation matter more than revenue or detailed metrics at this stage.

2. A bottom-up market view builds the most credibility. Real customer counts and realistic adoption rates outperform broad analyst TAM claims.

3. Validation signals carry significant weight. Waitlists, pilots, LOIs, advisor involvement, and competitive program acceptances prove early interest.

4. The funding ask must tie directly to milestones. Investors want a clear explanation of how each dollar moves the company closer to product market fit.

Pre-seed fundraising sits between concept validation and revenue generation. Your pre-seed pitch deck serves as the critical tool for converting early insights into investor interest and securing the meetings that lead to committed capital.

At this stage, you lack the traction metrics that later rounds depend on. What you do have is a clear problem thesis, early market validation, and a team capable of execution. Your deck needs to communicate these elements with enough clarity that investors see the path from here to product-market fit. This guide breaks down exactly what belongs in a pre-seed deck, how to position each element, and what separates funded rounds from endless pitch cycles.

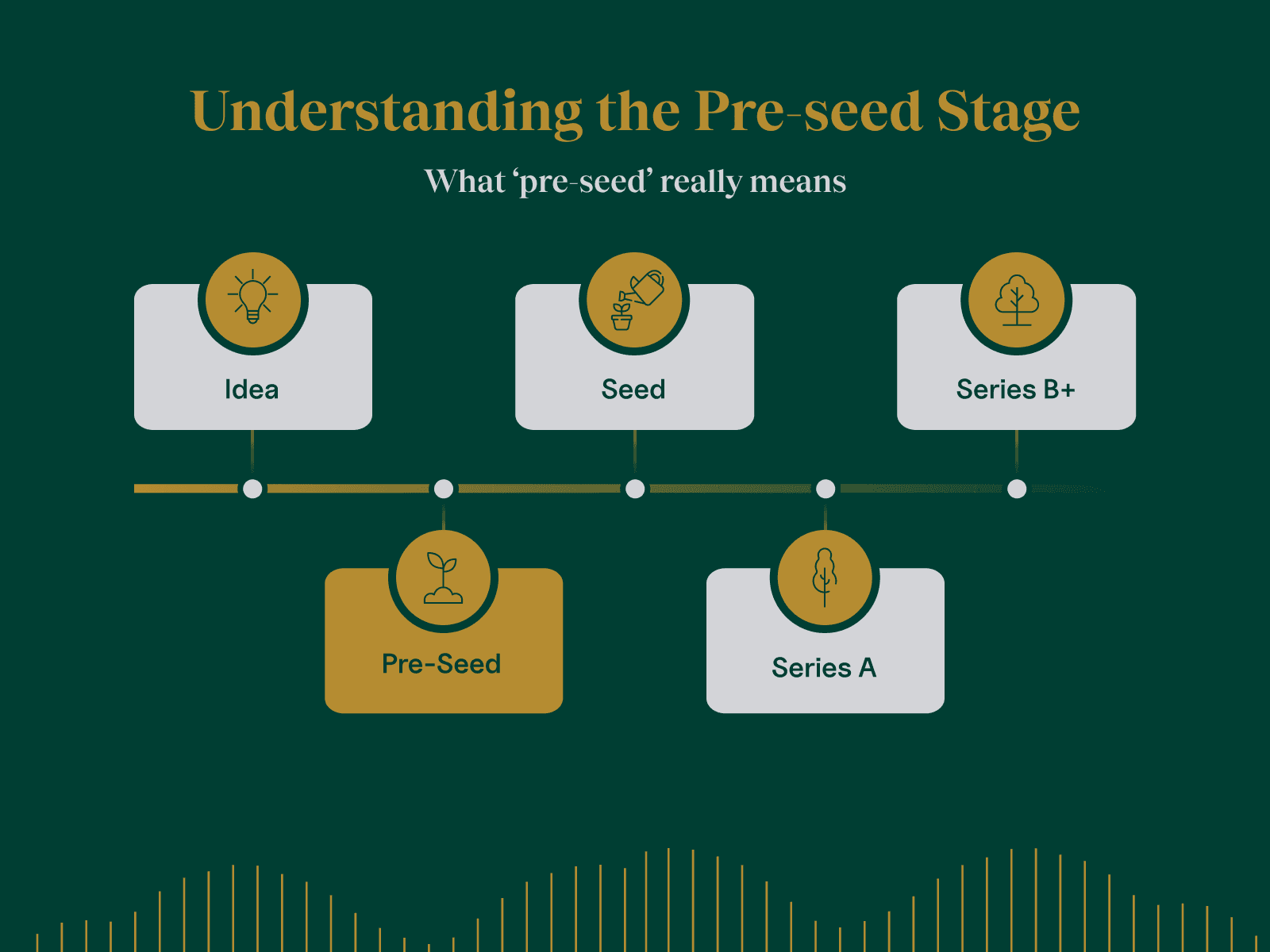

What "pre-seed" really means

Pre-seed describes the earliest institutional funding round, typically $250K to $2M, occurring before you've built significant product traction. Pre-seed has become the fastest-growing round type, now responsible for over 20% of all venture rounds globally.

The distinction from seed comes down to milestones. Seed investors expect evidence of product-market fit: paying customers, clear unit economics, validated retention metrics.

Pre-seed investors back you before these proof points exist.

Series A investors want scale evidence: predictable CAC, proven retention, and a path to $10M+ ARR. You're nowhere near that conversation yet.

Investor mindset at this stage

Pre-seed investors are pattern matchers asking: Does this team see something others miss? Can they execute? Is the market large enough to matter?

In 2024, pre-seed startups in the US raised $4 billion through more than 25,000 convertible instruments, with the median round size settling at $700K. The median pre-seed check sits between $50K and $250K per investor. You're typically raising from 8-15 investors, which means you'll pitch this deck 30-50 times before you're done.

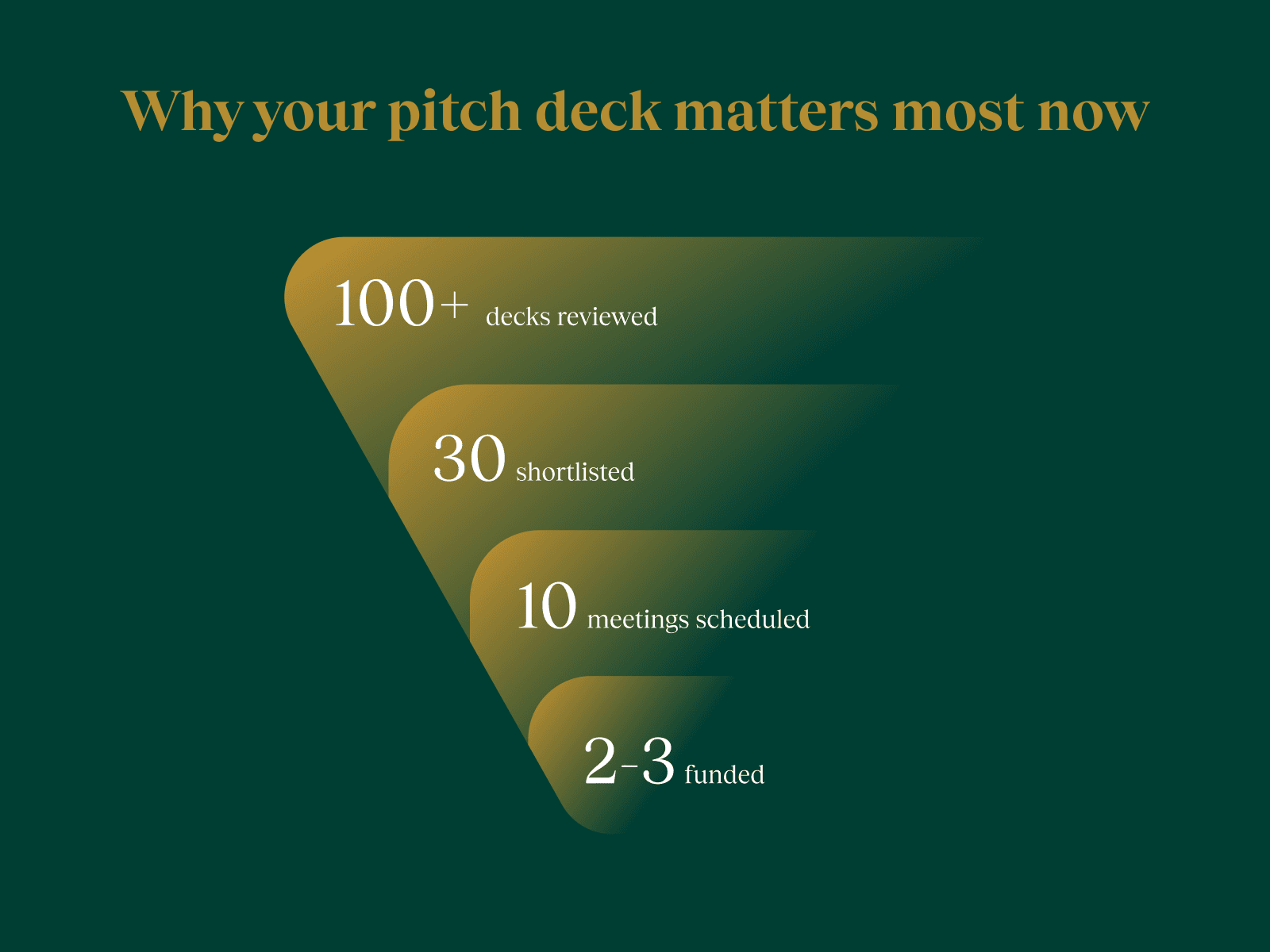

Why your pre-seed pitch deck matters most now

Later stages have defensibility: revenue, retention data, customer testimonials. Pre-seed relies almost entirely on how well you communicate the opportunity. Most pre-seed rejections happen in the first three slides. Investors decide whether to keep reading based on problem clarity and solution uniqueness.

1. Cover slide

State your company name, one-sentence tagline, and contact information. Avoid cluttering with multiple version numbers, confidentiality notices, or date stamps. Your cover slide should be scannable in two seconds and immediately communicate what category you operate in.

2. Problem

Define the specific pain point you're addressing. Quantify when possible. Include the problem's frequency since daily problems get solved faster. Add context about who experiences this problem and why current solutions fail. Show the business impact in terms of lost revenue, wasted time, or competitive disadvantage rather than abstract frustrations.

3. Solution

Show how your product directly addresses the problem. Use product screenshots or mockups even if you're in pre-launch. Explain your core insight: what did you figure out that others missed? Avoid technical jargon unless you're pitching technical investors. Focus on the outcome your solution creates rather than listing features. If you can demonstrate your solution in action through a brief visual workflow, that's stronger than describing capabilities.

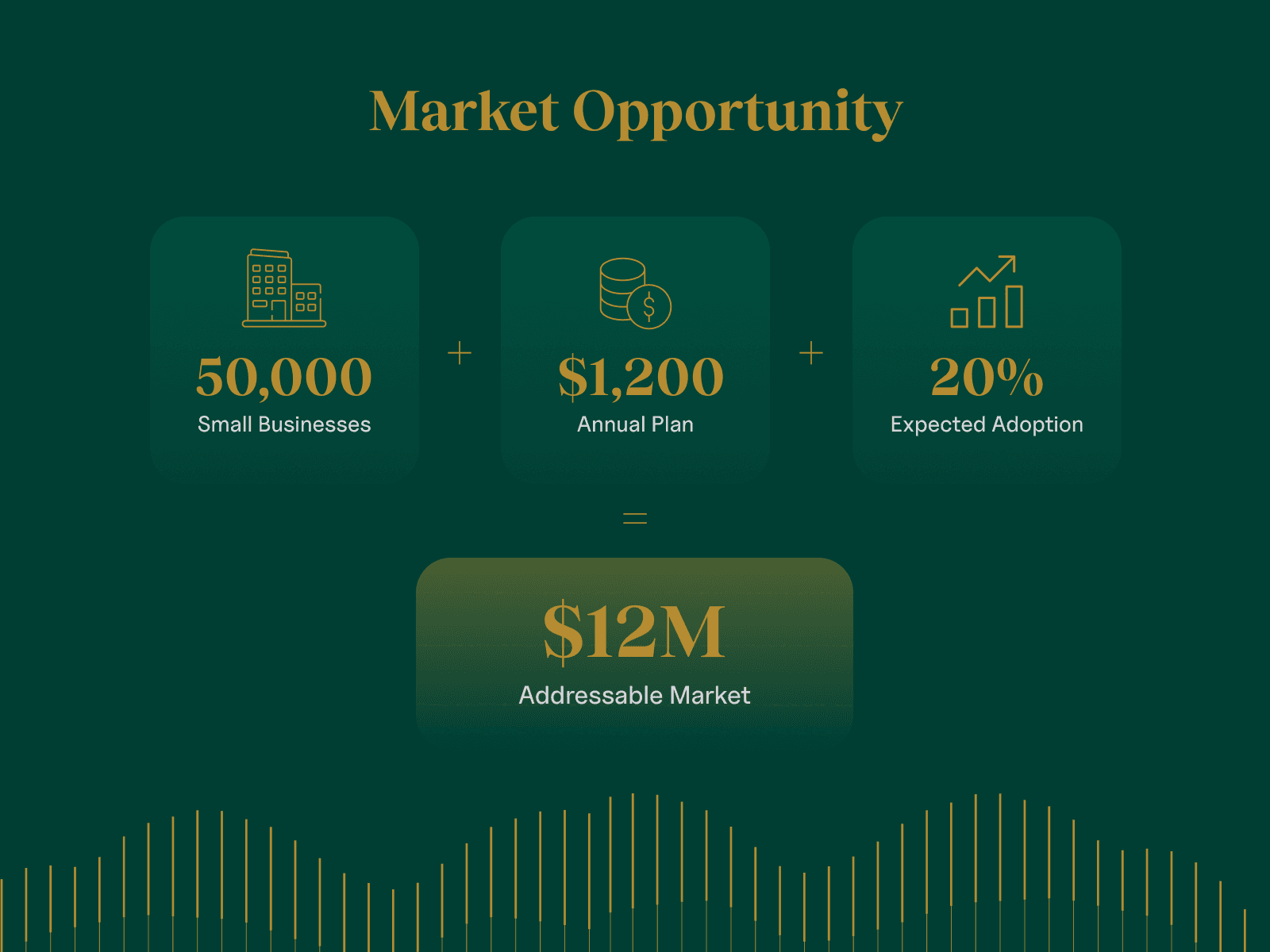

4. Market opportunity

Start with bottom-up market sizing by showing your calculation: X potential customers × Y average contract value × Z adoption rate. Include market growth indicators and explain why your market will be larger in three years, referencing specific trends, regulatory changes, or technology shifts that expand your addressable base.

Image requirement

5. Product or demo

Show your product even if it's rough, since screenshots usually work better than feature lists. Consider linking to a two-minute demo video rather than cluttering the slide with multiple screenshots. If you're pre-product, show detailed mockups that prove you understand what needs to be built and include annotations that highlight your key differentiators or unique workflow elements.

6. Business model

Explain how money flows into your company by including your pricing strategy with reasoning based on the value you create for customers. Show your unit economics hypothesis even without customer data, and if you have tiered pricing, display the structure with target customer segments for each tier. Explain your revenue model's scalability and whether you expect expansion revenue from existing customers over time.

7. Traction or validation

Strong pre-seed traction signals include pilot programs with recognized brands, LOIs from potential customers, waitlists of qualified prospects, or early users with strong weekly retention. Even pre-product, show demand evidence from customer conversations and include any competitive program acceptances, industry partnerships, or advisor commitments that validate your approach. Specificity matters more than volume.

8. Competition and differentiation

Use a positioning matrix that shows clear differentiation on two axes that matter to customers, then explain why your approach wins while acknowledging where competitors are strong. Include both direct competitors and alternative solutions that customers are currently using to show that you understand the competitive landscape deeply enough to validate your piece of the market.

9. Go-to-market plan

Detail your customer acquisition strategy for the next 12-18 months by including channel specifics and showing your customer acquisition funnel with assumptions. Specify your initial target segment (company size, industry vertical, and specific buyer persona), then explain why this segment makes sense as a beachhead and how you'll expand from there. DemonstrateConvey your thinking of the full customer journey from awareness to closed deal.

10. Team

Highlight relevant experience that maps to your startup's needs and demonstrate why you have unique insights into this problem and market. Include advisors or early hires if they add credibility, and address obvious gaps directly. If co-founders have worked together previously, mention it since this reduces execution risk. Show complementary skills rather than overlapping expertise, e.g.,technical credibility plus sales experience plus industry knowledge creates confidence.

11. Financials and funding ask

State your raise amount and how you'll allocate capital by breaking down your budget by category. Show 18-24 months of runway with your requested capital and include specific milestones that demonstrate progress toward product-market fit. Explain what changes between now and your seed raise that makes that round easier to close, keeping your targets measurable so investors can evaluate whether you hit your goals.

4 common mistakes to avoid

Ignoring competition or claiming "no competitors." This signals that you haven't done basic market research. Every market has competition, including the status quo and manual processes. Show that you've mapped the landscape honestly and explain your specific advantages within it.

Overly vague market sizing. Citing broad TAM numbers from analyst reports tells investors nothing about your actual opportunity. Calculate your specific addressable market from the bottom up using real numbers: how many potential customers exist, what percentage fits your ICP, and what they'll realistically pay you.

Lack of clarity on how funds will be used. Saying you need capital to "build the product and grow the team" doesn't inspire confidence. Break down your burn rate by specific categories and show what milestones each dollar unlocks. Investors need to see you've planned your runway carefully and understand what metrics this funding will help you achieve.

Weak or missing team slide. At pre-seed, investors are primarily betting on your ability to execute. Include relevant experience that directly maps to your startup's needs and show complementary skills across co-founders. Address obvious capability gaps proactively with your hiring plan or advisor support.

Winning the investor conversation beyond the pre-seed pitch deck

The way you handle the conversation and follow-up determines whether you close the round. These practices separate founders who raise quickly from those stuck in pitch limbo.

How to present the deck: Never read your slides. Start with a 30-second overview, then walk through your deck at a pace that allows for questions. Pre-seed pitches should be conversations, not presentations.

Sharing etiquette: Send your deck as a DocSend link rather than a PDF to track viewing and update without sending new versions. Follow up within 24 hours after a pitch meeting with the deck, any promised materials, and clear next steps.

Preparing for investor questions: Expect questions about customer acquisition costs, retention and churn, team gaps, competitive response, and go-to-market economics. Have clear hypotheses even if you don't have data yet.

Building trust early: Investors back founders who are organized and credible from day one.

Incorporate as a Delaware C-Corp. This structure is standard for venture-backed startups and makes future fundraising easier.

Keep founder ownership healthy. Aim for founders to retain around 60–70% equity after the pre-seed round. This balance shows long-term commitment and leaves room for future funding.

Prepare your data room early. Include incorporation documents, founder and IP agreements, existing SAFEs or notes, and a clear cap table.

Preparing your deck

Building a strong deck requires the right tools and a systematic approach to quality control. The following resources will help you create a professional presentation and catch issues before investors see them.

Getting expert help

If you're finding it difficult to distill your story or position yourself clearly, working with a specialized partner can save you weeks of trial and error. Collateral helps early-stage companies refine their fundraising materials and sharpen their positioning before they start pitching. The right guidance early on can prevent months of rejected decks and confused investor conversations.

Design tools

Design tools like Canva offer accessible templates for non-designers, while Figma provides full design control for teams with in-house design capability. Several platforms now offer AI-assisted deck creation and purpose-built templates specifically designed for investor presentations.

Pre-pitch checklist

Before sending your deck, verify that every slide has one clear message, no typos exist anywhere, charts have clear labels, all links work correctly, competitor information is accurate, and financial projections are defensible. Run your deck past someone unfamiliar with your company. If they can't explain your business after reading it, revise before sending it to investors.

Trends in pre-seed decks for 2026

Visual quality and data presentation now signal professionalism as much as financial metrics do. AI-assisted insights are becoming standard, especially in slides that reference customer data, unit economics, or market modeling.

The investor ecosystem is also fragmenting into specialized micro-funds. Instead of pursuing broad seed firms, founders gain more traction by targeting investors who focus on their sector, geography, or business model. These niche funds tend to make faster decisions, deliver sharper feedback, and open networks that compound within your market.

Remote fundraising has shifted from an exception to the norm. Your deck must be fully self-contained, communicating context and logic without your narration. Each slide should stand on its own, while live meetings serve to deepen discussion rather than repeat what’s already visible.

Bottom line

A pre-seed deck is a financial narrative that earns attention in a market flooded with noise. Investors see hundreds of decks each month. The ones that stand out read less like sales material and more like early investment theses: concise, data-aware, and grounded in execution reality.

Treat your deck as a living document that evolves with every investor conversation. The most disciplined founders treat revisions as part of capital strategy. On average, top performers spend 40 to 60 hours refining their decks to clarify their assumptions, tighten their story, and align each slide with investor decision criteria. That effort compounds into better meetings, faster diligence, and higher close rates.

Frequently Asked Questions