Investors scan the competition slide in seconds. Make those seconds count with a clear landscape, honest positioning, and a narrative that proves you know how to win.

Dec 12, 2025, 12:00 AM

Written by:

Niko Ludwig

Table of Contents

Key Takeaways:

Clarity beats creativity. Make the slide instantly scannable so investors grasp who matters, where you sit, and why your position is durable.

Research drives respect. Base the comparison on verifiable information and define your criteria so the analysis is auditable.

Positioning is the point. Use the slide to show where you win and how you will defend that space, not just to list competitors.

Design for credibility. Keep the visual minimal and consistent with your brand, emphasize only a few decision-grade criteria, and connect the slide to execution.

No investor buys because of the competition slide, but they can dismiss because of it. The competition slide pitch deck works as a credibility filter: a quick read that says you understand the market and your place in it. Keep it clean, honest, and decisive so they can grasp your position in seconds and stay focused on your traction and GTM.

Let’s break down how to create a competition slide pitch deck that makes investors trust you, not question you.

Investors see hundreds of decks. Most of them blur together, but the competition slide is a litmus test. It quickly reveals whether a founder or executive operates with strategic clarity or naïve optimism.

The investor lens: credibility before creativity

When investors reach your competition slide, they’re subconsciously asking, “Do they really understand this market?” They want to see realism, not hype. They’re looking for evidence that you’ve studied the field, identified where existing players succeed, and defined how you can capture value without delusion.

For wealth management, venture-backed fintechs, or B2B platforms entering finance, this becomes even more important. Your market is mature, trust-based, and regulated so awareness of incumbents and compliance barriers signals professionalism.

The CMO/founder takeaway

For CMOs and growth leads, this slide doubles as a messaging audit. It proves whether your positioning resonates in the market. If your differentiators don’t align with client pain points (say, you emphasize “AI automation” when clients care more about regulatory reliability) you’re signaling misalignment.

A myth worth debunking

Saying “we have no competition” makes you look uninformed rather than unique. Every client is already solving their problem somehow, even if it’s with spreadsheets, consultants, or inertia. The smartest founders name these status quo competitors, then show why those solutions no longer fit a modern market.

Acknowledging competition strengthens your case by showing you’ve done your homework.

A great competition slide begins with research. Competitor analysis is the groundwork that transforms your visual from guesswork into strategic evidence.

Define your competitive scope

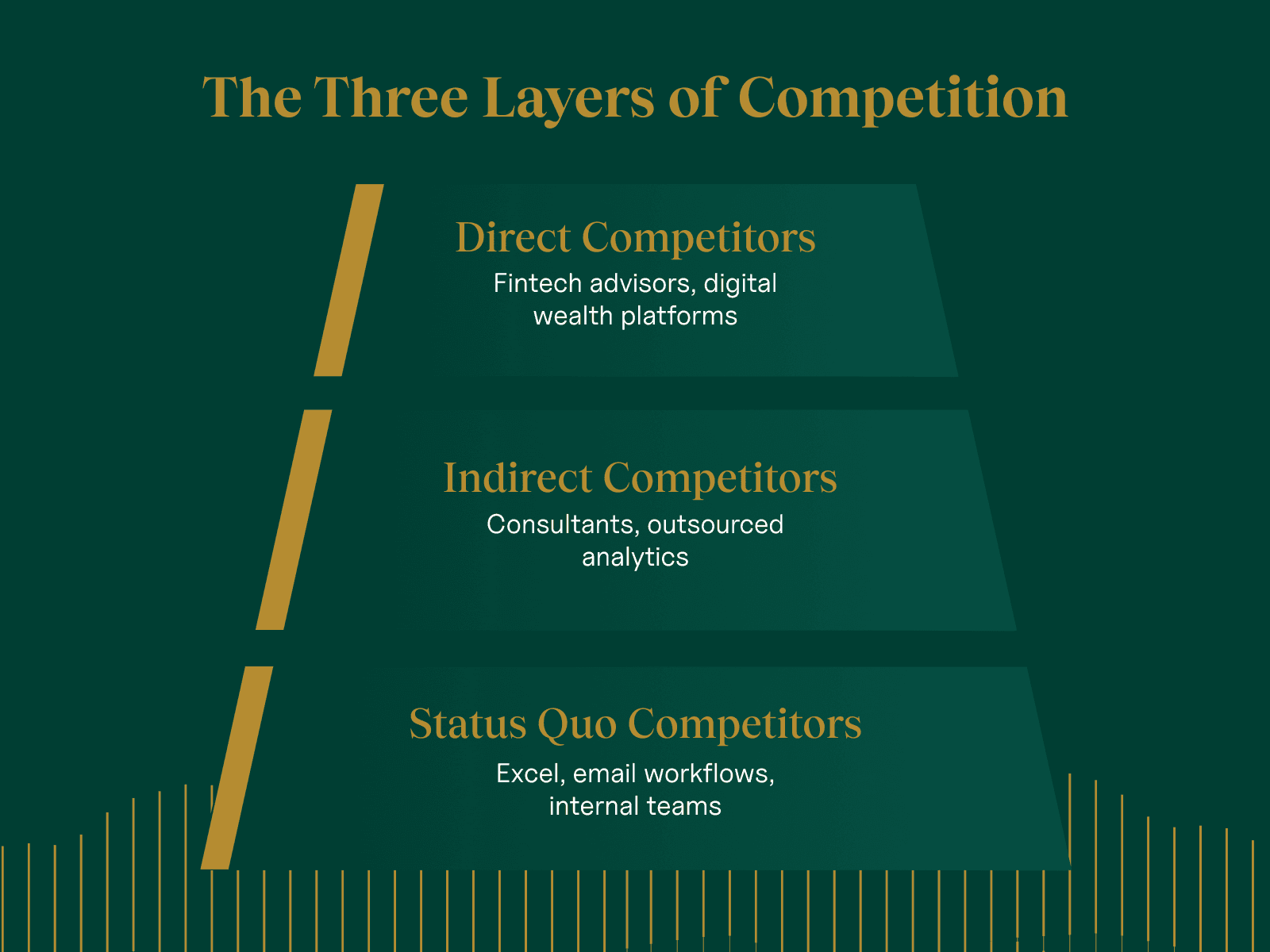

List three layers of competition:

Direct competitors: Companies offering a similar service to your same audience. Example: If you’re a digital wealth platform, this includes other fintech advisors.

Indirect competitors: Firms solving the same problem in a different way. Example: Consulting firms offering outsourced analytics.

Status quo competitors: Clients doing it themselves, often inefficiently. Example: A boutique advisory firm still managing AUM through Excel and email.

Mapping all three gives you a more realistic landscape and avoids the “we’re the only ones” pitfall.

Use credible data sources

Don’t rely on intuition or Google headlines. Pull insights from:

Funding and valuation databases (Crunchbase, CB Insights)

Investor or analyst reports (especially for financial tech trends)

Client and partner feedback

Digital signals: SEO performance, LinkedIn ads, paid campaigns

Public filings or press releases (for compliance-focused sectors)

This blend of sources helps you identify how competitors talk about themselves, which is practically a goldmine for refining your messaging.

Focus on true differentiators

Avoid comparing every feature. Instead, spotlight 3–5 strategic levers:

Regulatory credibility: e.g., “Registered with SEC/FINRA compliance integrations.”

Trust mechanisms: Verified data sources, audited models.

Customer intimacy: Bespoke, relationship-driven service models.

Scalability: Tech that allows lean expansion.

Integration capability: Compatibility with existing financial tools.

Remember, differentiation isn’t about being the loudest, it’s about being the safest bet.

Frameworks that clarify the story

Use SWOT to summarize your positioning fast, or Porter’s Five Forces to frame external pressures. For instance, if regulatory risk is high and barriers to entry are significant, emphasize your compliance maturity.

Choosing the right format for your competitive landscape slide

Choosing the right format for your competitive landscape slide

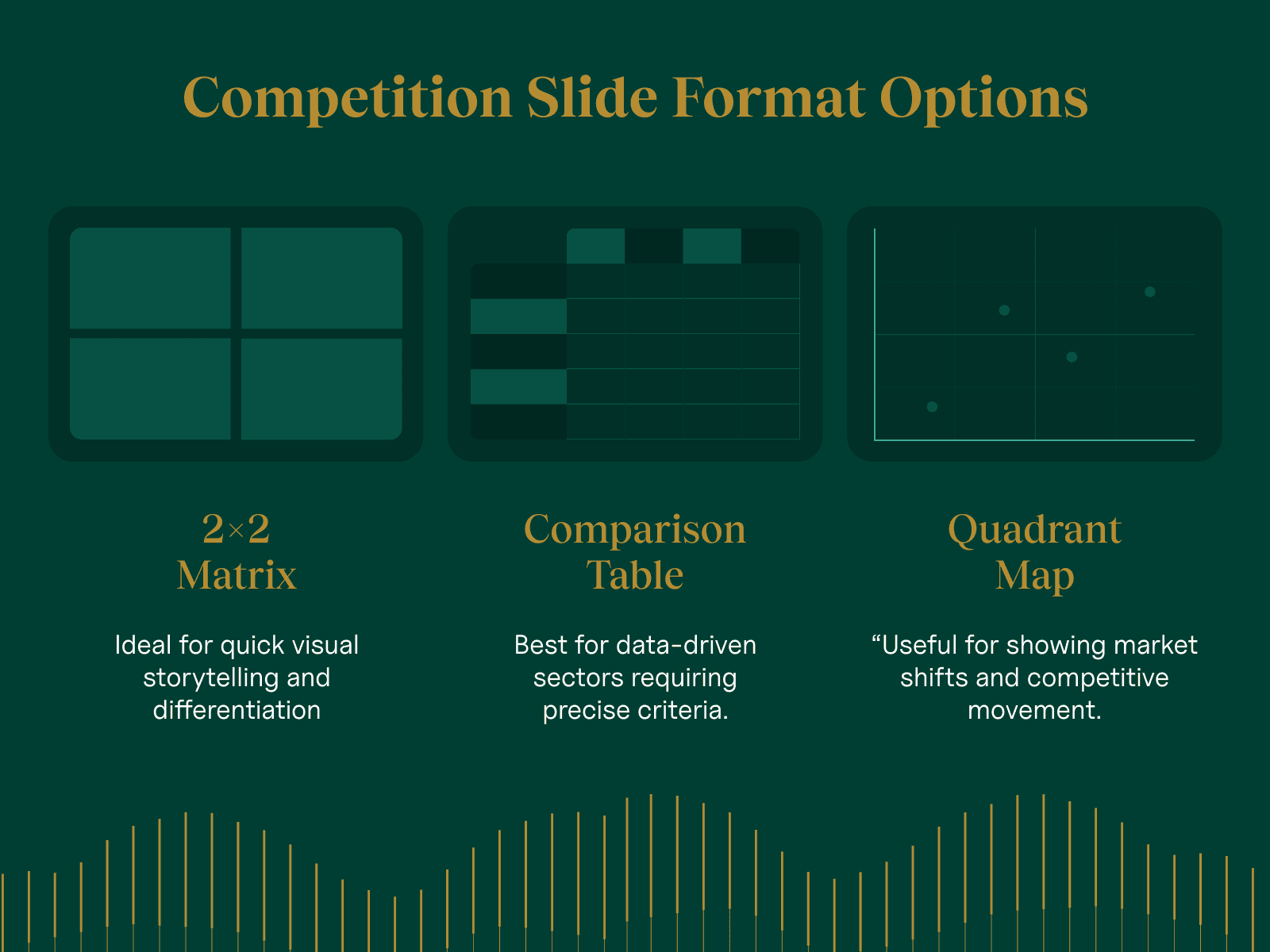

Once you know what you want to say, the next step is how to show it.

Simplify the visual

Investors spend seconds on each slide. Your competitive landscape pitch deck should deliver instant clarity. Stick with one structure:

A 2×2 matrix (ideal for visual storytelling)

A comparison table (works well for data-driven sectors)

Or a quadrant map (best if you want to illustrate market movement)

Pick meaningful axes

Avoid vague labels like “innovation” or “market reach.” Instead, tie them to measurable, relevant dynamics:

Automation vs Client personalization

Tech integration vs Regulatory compliance maturity

Price efficiency vs Value-added analytics

These dimensions speak directly to investor logic: scalability, defensibility, and risk.

Highlight your advantage subtly

You don’t need to dominate every corner of the chart. Instead, use shading, emphasis, or a subtle halo effect around your company’s position. This invites confidence rather than arrogance, a tone finance investors appreciate.

Design cues that project credibility

Stick to brand-consistent colors.

Keep fonts consistent across your deck.

Use whitespace to avoid cognitive overload.

Replace icons with clean labels where possible.

Your competitive landscape slide pitch deck should feel like something a CFO could share with their board. Professional, minimal, and credible.

Crafting a competition narrative that wins investor trust

A chart alone doesn’t persuade; the narrative around it does. Your goal is to translate the competition slide pitch deck into a concise, defensible argument investors can process in seconds.

Lead with an insight, not aesthetics. Open by stating the specific market gap your audience cares about. Anchor it in an observed pain or unmet need, not in design choices or feature lists.

Clarify your positioning in one sentence. State precisely where you play and why that position is defensible. Keep it short, verifiable, and tied to buyer value, not generic superlatives.

Link the narrative to traction. Immediately connect your position to measurable outcomes (growth, efficiency, quality, cost, retention). Make it obvious that your understanding of the landscape drives results, not just rhetoric.

Add finance-sector credibility. Explicitly address compliance maturity, integration with existing systems, reliability, and governance. This aligns with the expectations set by SEC Rule 206(4)-7.

Maintain logical flow across slides. End by pointing to what comes next (GTM, pipeline, partnerships, or KPIs). The competition narrative should naturally hand off to how you win and scale.

This approach converts the pitch deck competitor analysis from a static comparison into a trust-building argument: you understand the market, your position is intentional, and that position is producing outcomes under real constraints.

6 mistakes to avoid when designing your competitors slide

Even strong teams fall into predictable traps. Avoiding these mistakes instantly sets your deck apart.

1. Saying “we have no competition”

Investors hear this line all the time. Acknowledge the full landscape, including direct, indirect, and status quo alternatives such as internal teams, spreadsheets, or legacy systems. Then show where you fit and why that position is sustainable. Ignoring reality makes you look inexperienced.

2. Designing self-serving visuals

Vague axes such as “innovation” versus “customer love” do not communicate much. Use measurable, decision-focused dimensions like compliance maturity, integration depth, scalability, or cost efficiency. Briefly define the criteria so the logic is transparent and defensible.

3. Overloading the grid

A large table with dozens of competitors and checkboxes overwhelms the reader. Focus on three to five factors that matter most to buyers and investors. If your solution performs better, illustrate how it delivers meaningful outcomes such as faster onboarding or lower risk, rather than showing endless green ticks.

4. Ignoring indirect rivals

In B2B finance, inertia is often your biggest competitor. Many clients prefer to maintain the status quo because switching feels risky or complex. Explain how you address that barrier, whether through migration support, compliance assurances, or integration with existing systems.

5. Stale information

Markets move quickly, especially in fintech. Update your competition slide regularly to reflect funding changes, new entrants, or product updates. Add a simple source note or date so investors see you are tracking developments in real time. Outdated data undermines credibility.

6. Missing a narrative link

The competition slide should naturally lead to your next section, usually Go-to-Market or Traction. End with a short bridge that connects your position to how you plan to win and scale. Without that link, the analysis feels disconnected from execution.

Turning the competition slide into a strategic asset

Think beyond the deck. A sharp competitor slide pitch deck can become a core business tool.

For CMOs and marketing leaders

Your competitor research provides insight into messaging, pricing, and campaign tone. If your map shows incumbents winning on “trust,” but lagging on “innovation,” you’ve found your angle.

Your marketing copy should mirror that insight:

“Built for trust, delivered with modern agility.”

The slide becomes both internal alignment and external positioning.

For founders and CEOs

The competition slide clarifies your investor story. You can articulate where you stand and how you’ll defend that space. Use it as a framework for quarterly reviews or board updates. Over time, it becomes a living reflection of your strategy.

For financial and wealth-management firms

Competition analysis can expose partnership opportunities. Maybe a “competitor” in the low-compliance quadrant becomes your API partner. Or an incumbent you admire might be your next acquisition target.

Include measurable proof

Support your claims with hard numbers investors can verify:

AUM growth: “+28% YoY versus market average of 10%.”

Client retention: “94% over 12 months.”

Compliance advantage: “Zero audit findings in 24 months.”

Efficiency: “Cut onboarding time by 40% compared to the top three competitors.”

This shifts the slide from subjective to strategic and avoids the pattern of weak market grounding summarized by CB Insights.

End with action

Audit your current slide. Ask:

Does it show I understand my market?

Is it visually simple and credible?

Does it connect to my story and traction?

If the answer to any of these is “no,” then it’s time to rebuild it.

Quick checklist for your pitch deck competition slide

Use this before every presentation or investor send-out:

Identify 5–7 competitors. You can go with a mix of direct, indirect, and “do-nothing” alternatives.

Choose axes or criteria that truly matter (e.g., automation, compliance, personalization, scalability).

Write a one-line positioning statement (e.g., “The only advisory platform combining personalized insights with enterprise-grade compliance.”)

Keep design consistent. Always use your brand palette and spacing.

Validate the data quarterly. Market perception evolves faster than you think.

Ensure it transitions naturally into your Go-to-Market or Traction slide.

Always tie your edge to measurable outcomes: time savings, cost reduction, or trust metrics.

Bottom line

Right now, your competition slide is either working against or for you.

Pull up your current deck. Look at that slide with fresh eyes. Does it show a founder who knows the field, or one who's guessing? Does it position you in a space you can defend, or does it paint you into a corner you haven't thought through?

On average, investors will spend 34 seconds on this page. In that window, they're deciding whether you're strategic or hopeful. The gap between those two perceptions is the difference between a second meeting and a polite pass.

Fix the axes. Cut the clutter. Add the proof. Make it a slide you'd bet your next round on, because that's exactly what you're doing.

Frequently Asked Questions