Learn how to build a seed pitch deck that meets modern investor expectations by focusing on clarity, data, and a credible path to early traction.

Dec 9, 2025, 12:00 AM

Written by:

Niko Ludwig

Table of Contents

Key Takeaways:

Lead with clarity, not creativity. A strong seed deck follows a logical, data-driven structure. Investors should understand your problem, solution, and growth path in a few minutes.

Build credibility slide by slide. Each visual, metric, and statement should reinforce professionalism and reliability. The tone and design of your presentation are part of your reputation.

Compliance is part of your value proposition. Financial and fintech founders who show awareness of regulatory expectations earn investor confidence faster than those who ignore them.

Let the data tell the story. Focus on metrics, client traction, and measurable business outcomes. Replace adjectives with verified results to make your pitch believable.

A seed pitch deck is the first strategic narrative that defines how a company intends to grow. It helps you establish credibility and a clear direction from the very first interaction with investors

This guide takes a structured, data-driven approach for professionals who lead marketing, growth, or communications functions. It's written for early-stage companies of any type and focuses on what modern seed investors actually want to see.

You’ll learn how to build a deck that works not only for venture capital but also for strategic investors and corporate partnerships, and how to adapt each slide to their expectations.

What the seed round means in finance

Seed funding used to be primarily about the promise of a market opportunity. Investors were comfortable backing a strong team with a compelling idea, even if the product was early and traction was minimal. A seed deck could lean heavily on vision, market size, and long-term potential.

That dynamic has shifted. Seed investors now expect early proof, not just potential. The bar has moved from concept validation to market validation, and the definition of “seed-ready” has expanded to include:

Evidence of early customer engagement

Pilot programs or active product testing

Initial revenue experiments or contracted opportunities

A defined go to market motion with real signals

Clear thinking around compliance and regulatory exposure, especially in finance and fintech

In the past, seed rounds functioned as the stage where founders explored what might work. Today, seed rounds are expected to demonstrate what is already working, even if only at a small scale.

What investors are looking for

At seed stage, you need credible team DNA and data supported market insights. These two signals tell investors that the opportunity is real and that you are the right people to pursue it.

A credible team is one with relevant experience, complementary skills, and a clear connection to the problem. Investors respond to founders who have worked in the industry, solved similar problems before, or bring insight that others cannot easily copy.

Data supported market insight matters because it shows that your understanding of the customer is grounded in evidence, not assumptions. This can come from structured interviews, early pilots, waitlists, or measurable pain points. Even small data points help investors see that real buyers exist and that the solution aligns with real demand.

A strong seed deck brings these signals forward early so investors immediately understand why your team and your opportunity stand out.

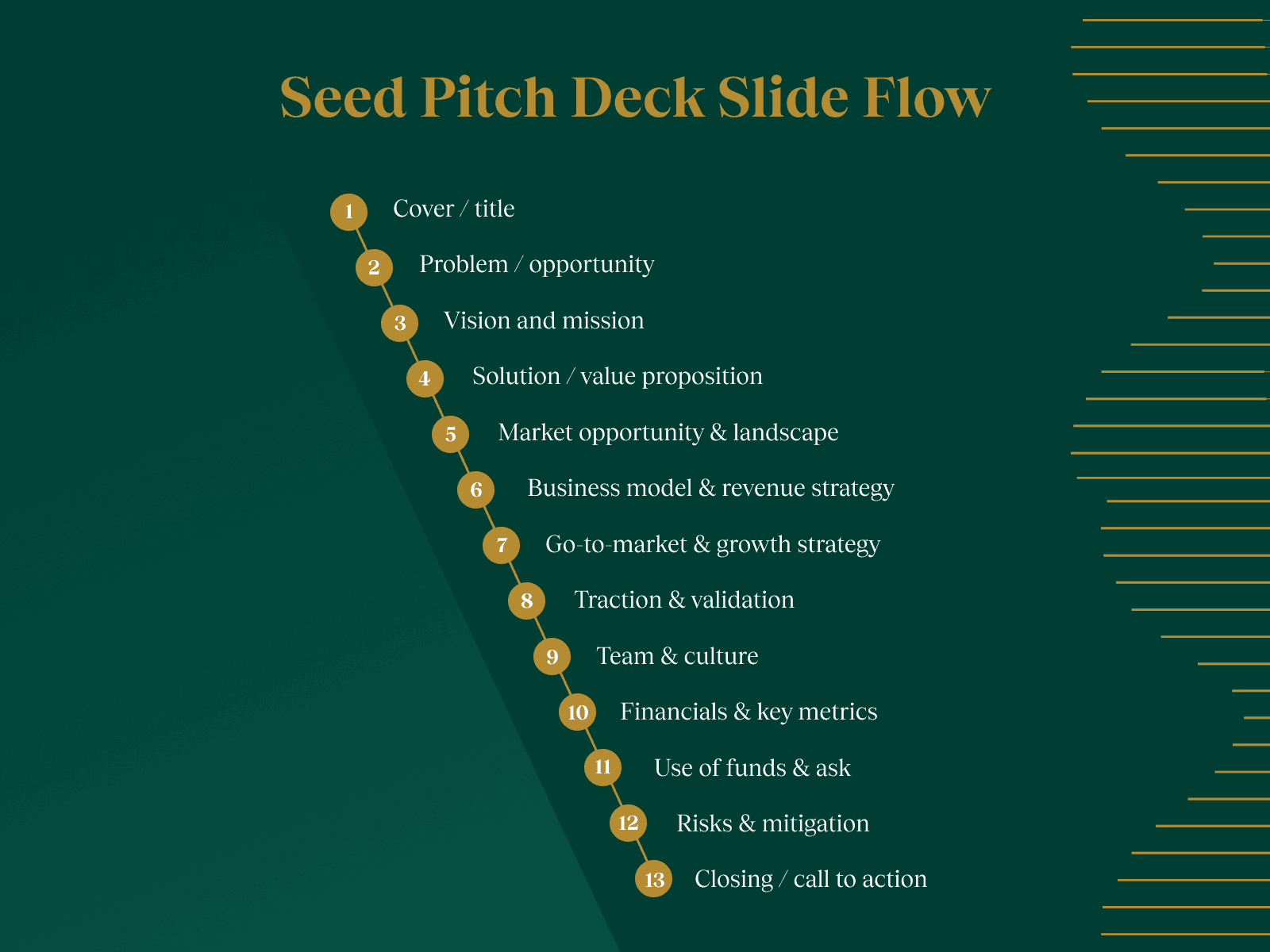

Each slide in a seed deck should answer a business question and build investor confidence. For finance-focused firms, clarity and precision matter more than creative flair.

1. Cover / title

Keep the design clean and polished. Include:

Company name

Tagline

Logo

Contact details

2. Vision and mission

At an early stage, vision and mission slides show investors where you’re headed and why it matters. A strong vision connects present execution to long-term ambition. It helps investors believe you’re building something with staying power, not just chasing a trend.

A compelling vision statement should sound real, not abstract. Use plain language, tie it to the core problem you solve, and frame where your company can go if things scale.

Here are some startups pitch decks which offer useful inspiration:

Airbnb: In its early deck, Airbnb framed its mission around enabling “people to belong anywhere.” That simple idea captured a broad, human-centered vision: travel as community, not just accommodation.

Uber (originally UberCab): Their early vision emphasized transforming urban transport: providing reliable rides on demand to solve the inefficiencies of taxi systems. That clarity helped investors see the potential for scale.

Dropbox: In its early pitch materials, Dropbox highlighted a future where files live in the cloud and are accessible from anywhere, making digital storage seamless. That vision aligned with emerging user needs and plain frustration with traditional file management.

3. Problem/opportunity

Explain the problem your audience faces and why it matters, making the impact of the problem obvious and relatable. Use simple, strong data points making the opportunity feel real and urgent. Examples:

“65% of users abandon onboarding because verification takes too long.”

“Finance teams lose 8 hours per week reconciling payments across tools.”

“One in three SMBs pays for duplicate software because they cannot track usage.”

“Most customer support teams switch systems 1,000 times per day, slowing response times.”

“Up to 30% of potential revenue is lost when follow-up happens more than 24 hours after lead creation.”

4. Solution/value proposition

Share how your product solves the problem and what benefits it delivers. Avoid jargon and explain the value in concrete, real-world terms. Investors should instantly understand how a user’s life or workflow improves.

Focus on outcomes:

Time savings: An onboarding workflow that eliminates manual data entry, reducing a 45-minute process to under 5 minutes.

Higher efficiency: An automated reconciliation tool that processes 10,000 transactions in seconds instead of requiring hours of analyst review.

Lower costs: A predictive routing system that cuts payment failure rates by 30 percent, reducing fees or operational overhead.

Better experience: A consumer fintech app that simplifies budgeting so users understand cash flow at a glance rather than navigating complex spreadsheets.

5. Market opportunity & landscape

Present the size and potential of your market using TAM (Total Addressable Market), SAM SAM (Serviceable Available Market), and SOM SOM (Serviceable Obtainable Market). Then map the competition:

Direct competitors

Indirect, alternative, or “do-nothing” options

Highlight what makes you different using measurable proof, not adjectives.

6. Business model & revenue strategy

Explain how you make money and why this model fits your market. Seed investors want simple, credible logic, early signals of willingness to pay, and a clear path to scalable revenue.

Common models include:

Subscriptions: Predictable recurring revenue, ideal for SaaS and fintech tools.

Usage or volume-based: Revenue tied to consumption, common for APIs and payments.

Licensing: Higher contract value with longer sales cycles, often in enterprise or regulated sectors.

Marketplace fees: Earned from transactions between buyers and sellers, requires early liquidity signals.

Strengthen this slide by showing:

When you expect to generate revenue

Basic unit economics logic (what a customer costs vs what they pay)

Whether customers can expand accounts or increase usage over time

Any early signs of willingness to pay, such as pilots, trials, or LOIs

Seed investors do not expect perfect financials. They expect a model that makes sense, can scale, and already shows early signs of demand.

7. Go-to-market & growth strategy

Show how you plan to acquire and retain customers. Investors want a clear, realistic strategy that aligns with your product’s strengths and the behavior of your target buyer. Avoid broad statements about “scaling quickly” and focus instead on the channels and motions you can execute well in the next 12 to 18 months.

Include the core elements of your strategy:

Key channels

Identify the channels you believe will work first, such as organic content, paid acquisition, partnerships, industry communities, outbound sales, or product-led growth. Explain why these channels fit your customer’s buying behavior and how you plan to test them.

Early traction indicators

Show early proof that your GTM motion is already starting to work. This can include waitlists, inbound interest, pilot requests, pipeline conversations, or customer testimonials from early testing. Even small signals help validate your assumptions.

Launch milestones

Lay out the concrete steps you plan to take after the seed round. Examples include launching your first paid pilot, hiring your first sales or customer success role, releasing a self-serve onboarding flow, or reaching your first revenue targets. Milestones show that your GTM is structured, time-bound, and achievable.

8. Traction & validation

Share progress so far:

Revenue, signups, users

Pilot results

Testimonials

Usage metrics

Waitlists

If you’re early, share what you’ve learned and how your metrics are trending.

9. Team & culture

Introduce core team members with short bios that show why they’re the right people for this problem. Highlight complementary skills and relevant experience rather than long resumes.

10. Financials & key metrics

Provide straightforward projections and the metrics that matter most:

Revenue forecasts

Gross margins

CAC

LTV

Retention

Aim for realistic, defensible numbers. Investors usually respect transparency far more than aggressive estimates.

11. Use of funds & ask

Share:

How much you’re raising

How you’ll allocate it

What milestones it unlocks

Example:

Product development (40%)

Marketing and growth (30%)

Key hires (20%)

Operations (10%)

Make it easy for investors to see how their capital accelerates your momentum.

12. Risks & mitigation

Investors appreciate honesty, so we recommend you to call out key risks with brief mitigation strategies. Keep this section simple: two or three well-articulated risks are enough.

13. Closing/call to action

End with a clean, confident summary of the opportunity.

Invite next steps:

A follow-up call

A demo

Access to your data room

Keep the final slide clear and uncluttered: it’s the one investors remember.

Design and delivery tips

Storytelling and narrative flow

A seed deck works when the story feels clear and inevitable. The flow should answer three things fast: what problem you solve, why your solution matters, and why now is the right moment. Keep the narrative grounded in evidence. One strong insight beats ten dramatic claims.

Slide design best practices

Clean design earns trust. Use one idea per slide, simple visuals, and consistent formatting. Charts beat paragraphs. Screenshots beat feature lists.

Avoid: clutter, decorative graphics, and heavy text.

Aim for clarity, not creativity.

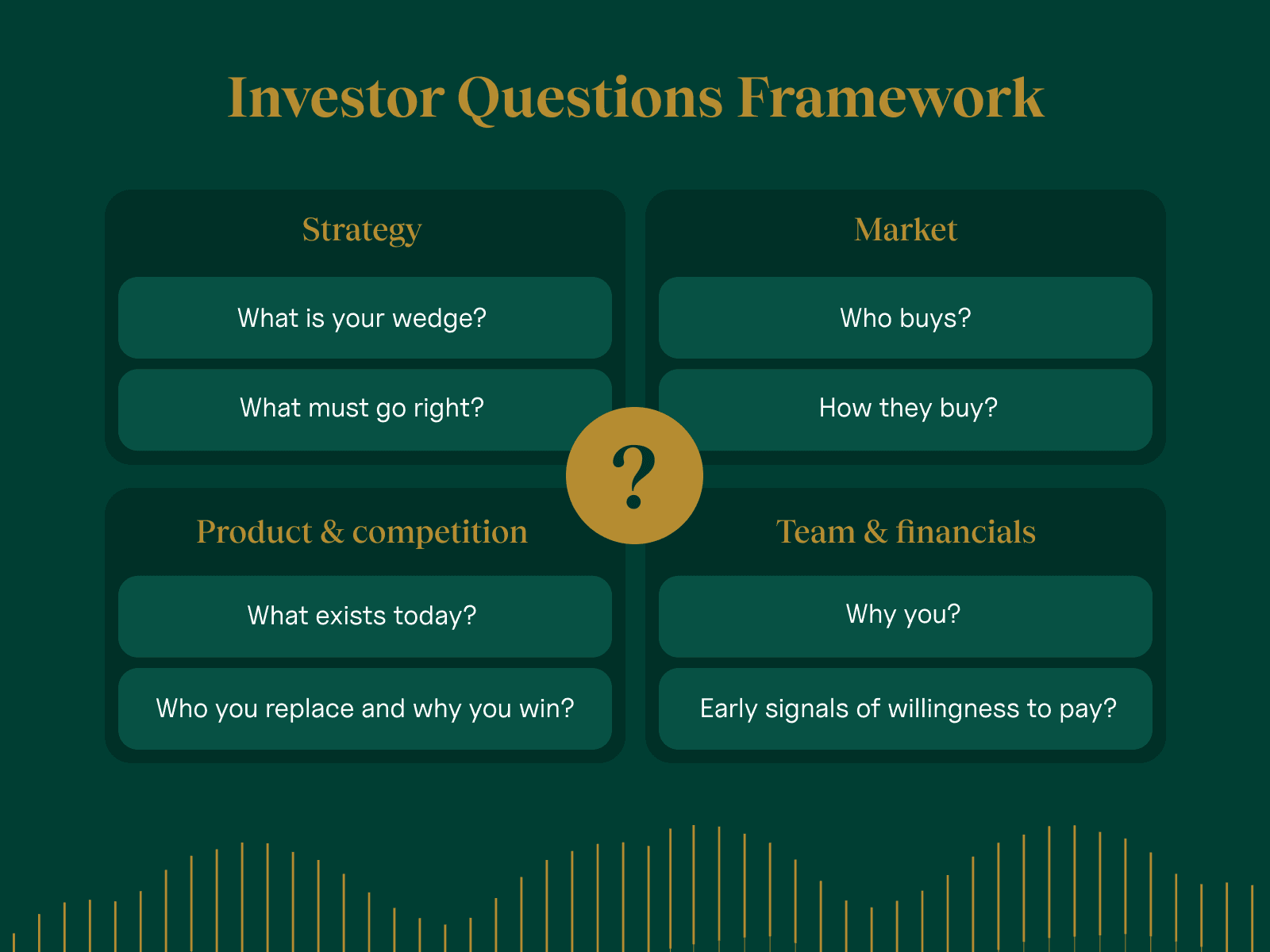

Preparing for investor questions

Investors will pressure test the story. Expect it. Prepare for it. Bring an appendix with metrics, product details, and early validation.

Strategy questions: Why now, what is your wedge, what must go right?

Market questions: Who buys, how they buy, and what you learned from interviews.

Product questions: What exists today, the hardest challenge, and why defensible.

Competition questions: Who do you replace and why do you win?

Team and financials: Why you, early signals of willingness to pay, key assumptions.

They want clarity of thought more than perfect answers.

Practice, pitch, and follow-up

Practice with people who do not know your business. If they cannot retell your story, tighten it. Keep the live pitch conversational, not scripted.

After the meeting:

Send a short recap

Include the deck link

Provide any requested materials

Suggest next steps

Fast, organized follow-up moves deals forward more than founders realize.

Special considerations for financial firms

Operational readiness factors

Unlike more established startups, early-stage companies must show they’ve thought through practical execution from day one. This includes basic process reliability, product stability, data handling standards, and early customer support structure. Mention any early frameworks you have in place, for example, data protection practices, product QA routines, or onboarding workflows, to show you’re building with discipline.

Building trust and credibility

Regardless of industry, reputation is a form of capital for young companies. Use credible design, authoritative messaging, and independent validation. Quotes from early users, pilot partners, or advisors build confidence faster than vision statements. Marketing leaders should align this credibility narrative across the deck, website, and all communications.

Customer acquisition and retention

Growth for most startups depends on combining acquisition with long-term engagement, not just one-off signups. Present acquisition metrics alongside retention and referral indicators. For example, highlight repeat-usage patterns, customer advocacy, or potential for expansion within existing accounts. Demonstrate how your growth model compounds over time rather than relying only on constant new customer acquisition.

Demonstrating differentiation in a crowded market

Investors know most markets are competitive. Differentiate by quantifying your advantage, whether it’s speed, cost, efficiency, accuracy, or ease of use. Instead of saying “better user experience,” show that your product reduces setup time by 60% or cuts manual tasks by 30%. Metrics beat adjectives.

5 common mistakes when building a seed pitch deck

Too much text or data-dumping: Overloaded slides cause investors to tune out. Prioritize clarity over quantity. Use one headline insight per slide and provide backup data in an appendix.

Vague story: If the sequence of your slides doesn’t create a logical flow, investors lose the thread. Test your narrative on a non-specialist colleague. If they can’t retell your story after ten minutes, simplify it.

Over-projection without credible support: Ambitious numbers without evidence reduce trust. Replace “we’ll grow to 10 million in two years” with “our acquisition model yields X% month-over-month growth across our early pilots,” or any proof-based equivalent. Data beats speculation.

Ignoring operational risks: Founders sometimes avoid discussing risks outside heavily regulated industries, but investors expect awareness of challenges such as customer adoption, competitive pressure, technical scalability, or long sales cycles (if relevant). Clearly outline how you plan to address your top risks.

Failing to tailor the deck to the audience: Adjust language for the investor type. A generalist VC may focus on growth, while a corporate investor values partnership potential. One universal deck rarely works for all audiences.

Bottom line

A strong seed pitch deck tells a clear business story: the problem you solve, the evidence behind your model, the trust you’ve built, and the milestones ahead.

For young companies, success lies in showing thoughtful execution, measurable early traction, and a foundation that can scale.

Start building your deck with this structure. Anchor every slide in data, make your design credible, and align your message with your firm’s growth narrative. A clear, confident story backed by real metrics can turn your seed deck into the foundation of your next funding milestone.

Frequently Asked Questions