Discover what sets high performing pitch decks apart. See why small choices in structure and clarity can change how investors respond.

Nov 27, 2025, 12:00 AM

Written by:

Niko Ludwig

Table of Contents

Key Takeaways:

Clarity shapes investor perception. When a pitch deck communicates the core strategy within the first few slides, investors understand the opportunity faster and with greater confidence.

Design is part of the narrative. Visual clarity and tight hierarchy guide how investors process information and interpret the manager’s level of preparedness.

Consistency reinforces trust. When the messaging across decks, websites, and materials aligns, investors perceive greater stability, coherence, and long term reliability.

Most pitch deck guides focus on one moment: the fundraising pitch. That's a mistake. Your pitch deck is a strategic asset that extends far beyond a single investor meeting. For CMOs, growth leads, and executives, the deck serves as your narrative backbone, aligning internal teams, opening partnership doors, and shaping board conversations.

This article targets marketing and growth leaders in B2B finance, wealth advisory firms, and fintech companies. You'll gain a practical framework for building pitch decks that work across multiple contexts, with specific considerations for the finance sector where regulatory credibility and trust signals matter as much as growth metrics.

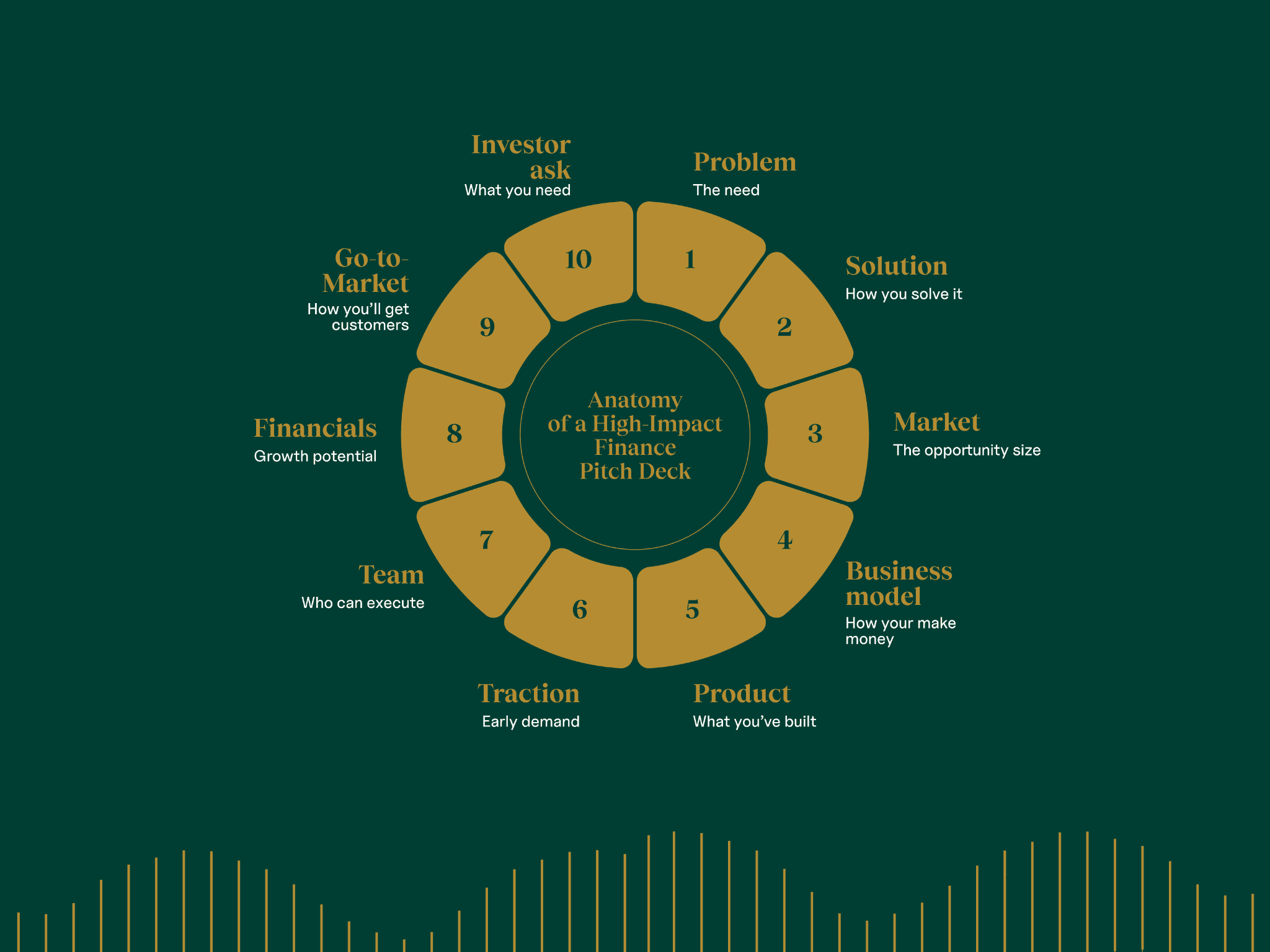

Every functional pitch deck includes these components:

Problem and opportunity: What market inefficiency or customer pain creates your opening. For wealth management firms, this might be demographic shifts in investor preferences or gaps in digital-first advisory models.

Solution: Explain how your product, service, or platform addresses the problem. In advisory businesses, detail whether you're offering technology, human expertise, or a hybrid model.

Market size and growth: TAM, SAM, SOM with credible data sources. Finance audiences expect conservative estimates backed by third-party research, not aspirational projections.

Business model: Explain how you generate revenue. For wealth and advisory firms, specify fee structures: AUM-based, subscription, transaction-based, or hybrid. Include unit economics.

Product or service delivery:

List what clients actually receive. In wealth management, explain the advisor experience, client onboarding process, and ongoing service model.

Traction and proof points: Show current metrics that demonstrate market validation. For early-stage firms: client count, AUM, retention rates, advisor acquisition. For growth-stage: year-over-year growth, client lifetime value, expansion metrics.

Team and operational capability: Share a profile of who executes the plan. Finance audiences scrutinize industry experience, previous exits, regulatory expertise, and operational track records.

Financials and projections: Convey historical performance and forward-looking models. Include revenue, gross margins, customer acquisition costs, and path to profitability. Finance firms should show scenario modeling.

Go-to-market strategy: Explain how you acquire customers and scale distribution. For B2B finance: direct sales to advisors, institutional partnerships, digital acquisition channels, or advisor network effects.

The ask: State the funding amount or partnership request, plus detailed use of funds. Specify allocation across technology, talent, regulatory compliance, and market expansion.

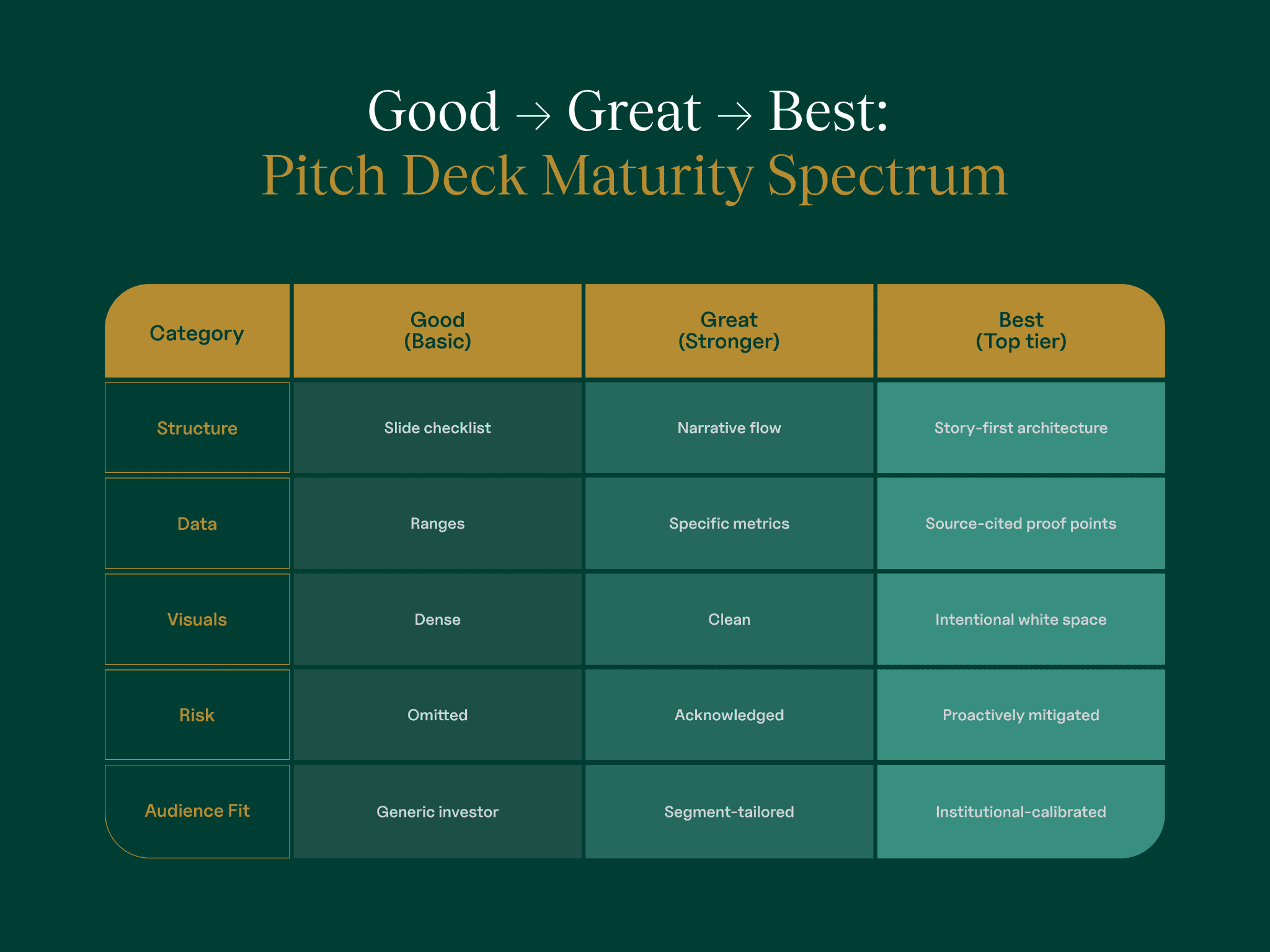

The best pitch decks become reference materials that demonstrate mastery of both content and form. They influence investor behavior, get shared internally at target firms, and serve as templates for others. For finance and wealth firms specifically, best decks balance growth ambition with operational maturity, showing that you understand the difference between moving fast and building institutions that last.

Visual clarity: The best decks use white space intentionally. Each slide presents one core idea and charts show data without interpretation burden. Color palettes reinforce brand positioning. For finance firms, this typically means restrained blues, grays, and professional typographic systems that create hierarchy rather than bright, consumer-facing palettes.

Story-first structure: Great decks organize around narrative momentum rather than slide checklists. The sequence builds tension, establishes stakes, and resolves with your solution. Readers can follow narrative lines that connect early problem framing to later competitive positioning.

Differentiation: Weak decks list features. Great decks articulate why competitors can't easily replicate your approach. Expert finance decks demonstrate moats through regulatory positioning, network effects, proprietary data, or relationship capital that takes years to build.

Data credibility: Specific numbers outperform ranges: "247 advisors using our platform, 94% retention after 12 months" beats "high advisor satisfaction." Finance audiences verify claims, so cite data sources and methodology.

Audience tailoring: Decks for institutional investors need different emphasis than decks for strategic partners or enterprise clients. Finance and wealth firms must address regulatory pathways, compliance infrastructure, fiduciary responsibility, and operational maturity.

Risk acknowledgment: Finance decks that inspire confidence proactively address regulatory risk, market risk, and execution risk with clear mitigation strategies. This demonstrates sophistication rather than naivety.

Examples and learning from the "best pitch decks"

Classic startup decks and their lessons

The Airbnb deck from 2009 gets referenced constantly for good reason. The founders used minimal text, clear problem-solution framing, and early traction data to tell a compelling story. The deck's strength: It made a weird idea (sleeping in strangers' homes) feel inevitable by anchoring it in real user behavior and market data.

Uber's early deck focused on the economics of the taxi industry and how technology could restructure the market. The slides emphasized unit economics and a city-by-city expansion strategy, showing operational thinking alongside vision.

Square's pitch deck demonstrated how financial services could work for small businesses that are overlooked by traditional banks. The visual design was clean, the business model was clear, and the market opportunity was precisely defined.

Key takeaways from these examples:

Simplicity wins: Apply one concept per slide with supporting visuals.

Traction validates vision: Early proof points matter more than elaborate projections.

Make the complex simple: Reduce your business model to its essential mechanics.

Finance, wealth, and fintech decks

Pitch decks in the finance sector require a different approach than pure tech plays. According to fintech pitch deck research, institutional investors place strong emphasis on regulatory compliance given the heavily regulated nature of the financial industry. For B2B wealth and advisory firms, successful decks often include:

Regulatory roadmap: Licenses obtained, in-process registrations, compliance infrastructure. Demonstrating regulatory awareness and compliance strategy is essential for reducing perceived risks among investors.

Client economics over user metrics: Finance partners want to see assets under management, average account size, client acquisition costs, lifetime value, and retention cohorts, e.g., "1 million downloads" matters less than "3,200 clients with $425M AUM, 18-month average relationship duration."

Advisor or partner acquisition: If your model involves advisors or institutional partners, show recruitment pipeline, onboarding timeline, average revenue per advisor, and churn rates.

Trust indicators: Industry certifications, third-party audits, insurance coverage, custodial relationships, and brand partnerships that signal credibility.

Common mistakes and how to avoid them

Overloading slides with text: Apply the "billboard test." Your slide should communicate its core message in three seconds. Use headlines that make claims, then support them with minimal text or visuals.

Lack of clear "why now": Build a slide identifying specific market catalysts: regulatory changes, technology maturation, demographic shifts. Use third-party data to validate timing.

Weak differentiation: Create competitive positioning that shows unique advantages on axes competitors can't easily match.Include aspects like network effects, proprietary data, regulatory barriers, exclusive partnerships.

Vague asks: Break down capital requests with precision: "$5M Series A. $2M to engineering (12 hires), $1.5M to advisor recruitment (250 advisors, 12 markets), $1M to regulatory expansion, $500K to marketing. Accelerates path to $20M ARR within 24 months."

Ignoring risk: Create a risks and mitigation slide acknowledging three biggest risks with clear mitigation strategies. Use concise, positive framing.

Generic templates: Start with proven structure but customize completely. Finance decks need different supporting evidence, competitive analysis, traction metrics, and team expertise than consumer apps.

Checklist for building your "best" pitch deck

Pre-deck checklist (strategy, audience, narrative)

Define your audience and objective: Are you fundraising (specify round and amount), pursuing a strategic partnership (name the type of partner), acquiring enterprise clients (specify target profile), or aligning internal stakeholders? Each objective requires emphasis shifts.

Map your narrative: Write out your story in 200 words without mentioning slides. Follow this structure:

The market has this problem

We discovered this insight

Our solution works this way

Proof it's working

Here's what we need to scale.

Gather proof points: For finance and wealth firms, collect:

Assets under management (current and historical)

Client count by segment

Advisor count and retention rates

Revenue and growth rates

Client acquisition cost and lifetime value

Retention cohorts

Regulatory licenses and compliance infrastructure

Partnership agreements or LOIs

Industry recognition or third-party validation

Pitch Decks for different cases

Why pitch decks aren't just for investors

Your deck articulates company stories in a format that travels effortlessly across audiences. Marketing teams align messaging. Sales adapts it for prospects. Product references it for roadmap priorities. Board members share it with networks.

The deck forces clarity on fundamental questions: What problem do we solve? How do we make money? Why do we win? Once answered, these inform every strategic decision.

Internal alignment and executive storytelling

A strong pitch deck creates narrative consensus across departments telling compatible versions of the same story.

Board strategy deck: Remove capital structure details, add strategic priorities, operational challenges, quarterly objectives.

C-suite alignment asset: Present quarterly, updating traction metrics and strategic priorities as a forcing function for leadership alignment.

New executive onboarding: Communicates not just what you do, but why you exist and where you're heading.

Partner, institutional and client versions

For institutional partnerships: Shift from growth metrics to integration capabilities. Detail API architecture, data security, implementation timeline, support infrastructure. Add SLAs, uptime guarantees, success case studies.

For enterprise clients: Lead with customer outcomes, not market opportunity. Show implementation processes, change management support, ROI timelines with references from similar firms.

Ongoing strategic use

Quarterly updates: Refresh traction metrics, competitive positioning, financial projections, new proof points.

Market expansion: Entering new geographies or customer segments changes your story while maintaining narrative consistency.

The best pitch decks become living documents that clarify thinking, align teams, and open doors.

Building trust by integrating risk, compliance and governance

Including risk and compliance effectively

Show regulatory awareness: Include specific details like SEC registration date, Form ADV availability, and independent audit schedules to demonstrate operational maturity.

Demonstrate proactive governance: Detail your compliance infrastructure, including reporting lines, meeting cadence, and documented procedures for critical operations.

Include security credentials: List certifications (SOC 2 Type II), testing frequency, insurance coverage, and security protocols that protect client data.

Address risk without fear: Use positive framing that acknowledges regulatory requirements while emphasizing your readiness and adaptability to rule changes.

Turning compliance into a differentiator

Position your regulatory infrastructure as a market advantage. Firms that invest early in compliance can reduce partner onboarding time significantly, improving time-to-revenue. Clients who understand your compliance framework demonstrate higher retention rates, translating trust into business durability. Your investment in regulatory infrastructure creates barriers to entry that new competitors must overcome without your established relationships and operational history.

The bottom line

Your pitch deck represents your strategic thinking in concentrated form. Build it well, tailor it specifically to finance and wealth contexts, and use it across multiple functions. The investment pays returns far beyond a single funding round.

Narrative clarity: Your story flows logically from market opportunity through solution to business model and traction. Every slide advances the narrative.

Visual discipline: One idea per slide. Clean design that signals professionalism. Data visualization that emphasizes insight over decoration.

Audience specificity: Finance and wealth decks require different emphasis than consumer tech. Regulatory readiness, trust signals, client economics, and risk mitigation matter as much as growth metrics.

Multi-purpose utility: The strongest decks serve as strategic infrastructure—used for fundraising, board updates, partner development, internal alignment, and executive onboarding.

Continuous evolution: Markets change. Your business adapts. Your deck should reflect current strategy and metrics quarterly.

Frequently Asked Questions