Learn how different pitch deck types align with specific goals and investor expectations so you can choose the right structure and communicate your story effectively.

Nov 26, 2025, 12:00 AM

Written by:

Niko Ludwig

Table of Contents

Key Takeaways:

Different investors evaluate different signals. Venture funds, family offices, and strategic partners each read the same slide through a different decision lens.

Deck types must match the objective. Fundraising, partnerships, investor updates, and exits require different structures, data, and tone to be credible.

Clarity and metrics drive retention. Investors remember decks that present concise narrative flow supported by verifiable numbers and clean visual hierarchy.

Using the wrong deck weakens the story. A misaligned deck confuses the audience, dilutes key messages, and disconnects the data from what stakeholders need to see.

A single “universal” investor pitch deck template does not exist. The firms that close deals treat their decks as adaptable communication tools shaped by audience, goal, and market context. Venture investors, corporate acquirers, and strategic partners each read slides through different lenses.

In the finance and advisory sectors, the gap is even wider. A deck built for a tech VC often underperforms when shared with family offices or institutional investors focused on long-term trust and risk control. Recognizing the different types of investor decks (and when to use each) is a fundamental part of raising capital and building partnerships efficiently

An investor pitch deck is a brief visual narrative designed to secure commitment, not just attention. In practical terms, it should:

Prove the commercial viability of your idea or firm.

Present measurable outcomes that investors can evaluate.

Highlight the management team’s execution record.

Make it easy for investors to recall key numbers after a meeting.

While most guides on this subject position the deck as a fundraising tool, companies in the financial and B2B sectors also use it for three other objectives: strategic partnerships, investor updates, and internal growth alignment.

Investor expectations have become more segmented. The structure, data, and tone must adapt depending on whether you are raising capital, building alliances, reporting progress, or preparing for an acquisition.

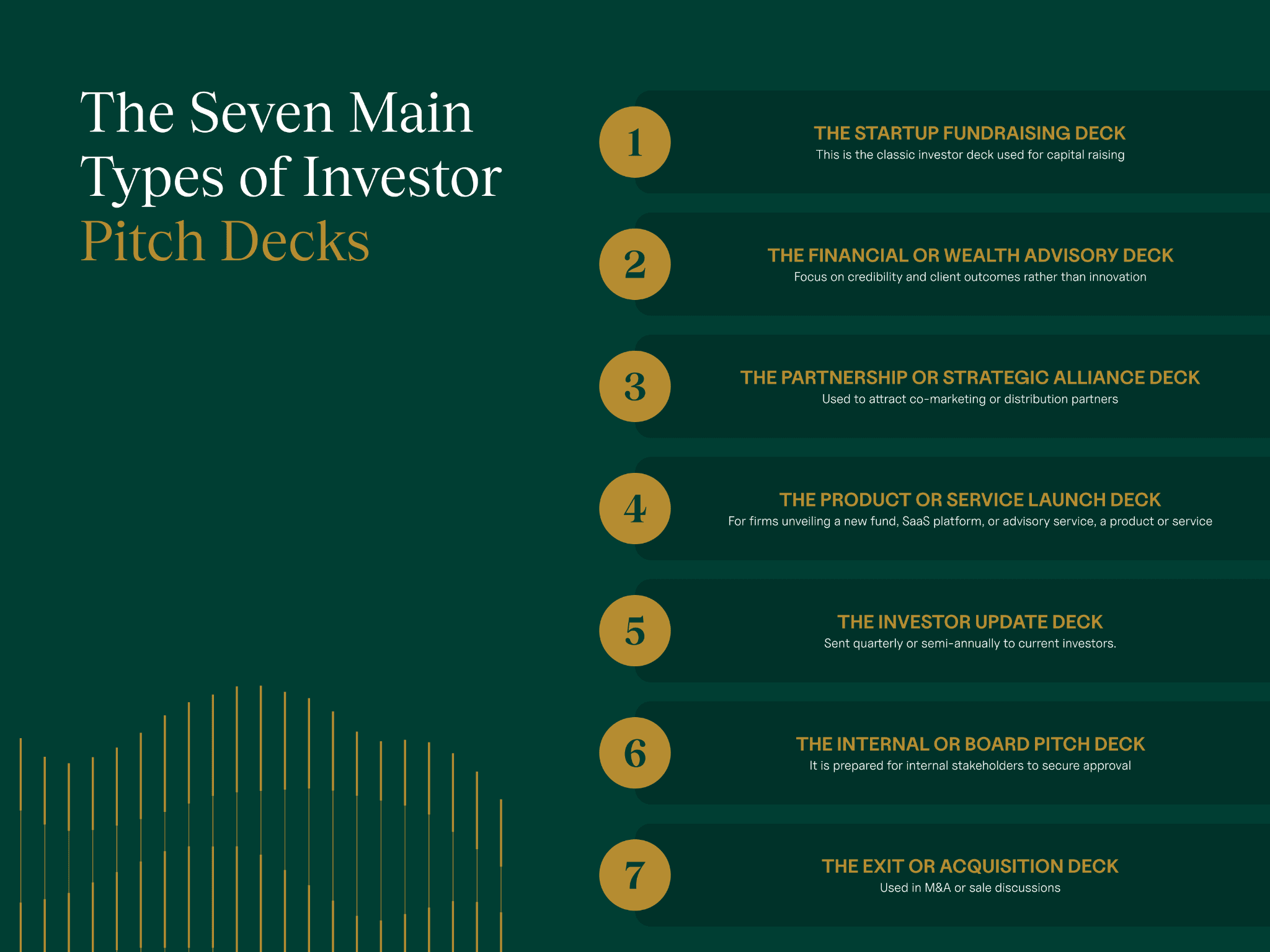

Below are seven proven deck types used by high-performing finance, advisory, and venture-backed firms to align story with objective and audience mindset.

The startup fundraising deck

This is the classic investor deck used for capital raising. It usually runs 10–12 slides, covering the problem, solution, traction, business model, and financial projections.

However, investors now expect earlier traction data and customer validation, even in pre-seed rounds. Use this version when your goal is to attract new capital and your data supports the investment case.

The financial or wealth advisory deck

This variation focuses on credibility and client outcomes rather than innovation. Slides emphasize assets under management (AUM) growth, client retention rate, and compliance readiness. A persuasive example includes performance metrics compared with relevant benchmarks and testimonials from regulated partners. Investors and potential acquirers use these signals to assess operational trust and recurring revenue stability.

The partnership or strategic alliance deck

Used to attract co-marketing or distribution partners, it highlights mutual benefit, aligned audiences, and shared revenue opportunities. CMOs and growth leaders often use this version to open B2B collaborations that expand reach without raising new funds.

The product or service launch deck

For firms unveiling a new fund, SaaS platform, or advisory service, a product or service launch deck positions the launch within market demand, pricing strategy, and projected client acquisition costs. This version prioritizes the go-to-market story, showing how distribution channels, marketing, and data infrastructure will create measurable growth.

The investor update deck

Sent quarterly or semi-annually to current investors, iIt contains progress reports, new KPIs, cash position, pipeline, and roadmap adjustments. Transparency is the goal. Investors value a concise view of what has been delivered versus what was promised, ideally supported by charts and time-series data.

J.P. Morgan's startup banking research emphasizes that consistent investor communication through regular updates builds trust and positions founders favorably for follow-on funding rounds.

The internal or board pitch deck

This type of deck is prepared for internal stakeholders to secure approval for a new initiative or market entry. It highlights expected ROI, cost structure, and risk exposure. For communications or marketing leads, this deck helps align cross-functional teams before external fundraising.

The exit or acquisition deck

Used in M&A or sale discussions, the focus shifts from opportunity to value realization: valuation logic, comparable transactions, integration benefits, and exit timelines. This deck works best when backed by third-party data, not projections.

How to choose the right deck type for your goal

Start with intent. If your objective is capital, the fundraising deck applies. For a partnership, use the alliance version. For transparency, choose the update format.

Each type requires different metrics:

Fundraising decks focus on growth rates and market potential.

Advisory decks focus on retention and AUM stability.

Partnership decks focus on shared audience reach or pipeline expansion.

Mapping the audience mindset is essential. Venture investors think in terms of return velocity, family offices in terms of stability, and strategic partners in terms of synergy. Align your story with that expectation before designing the first slide.

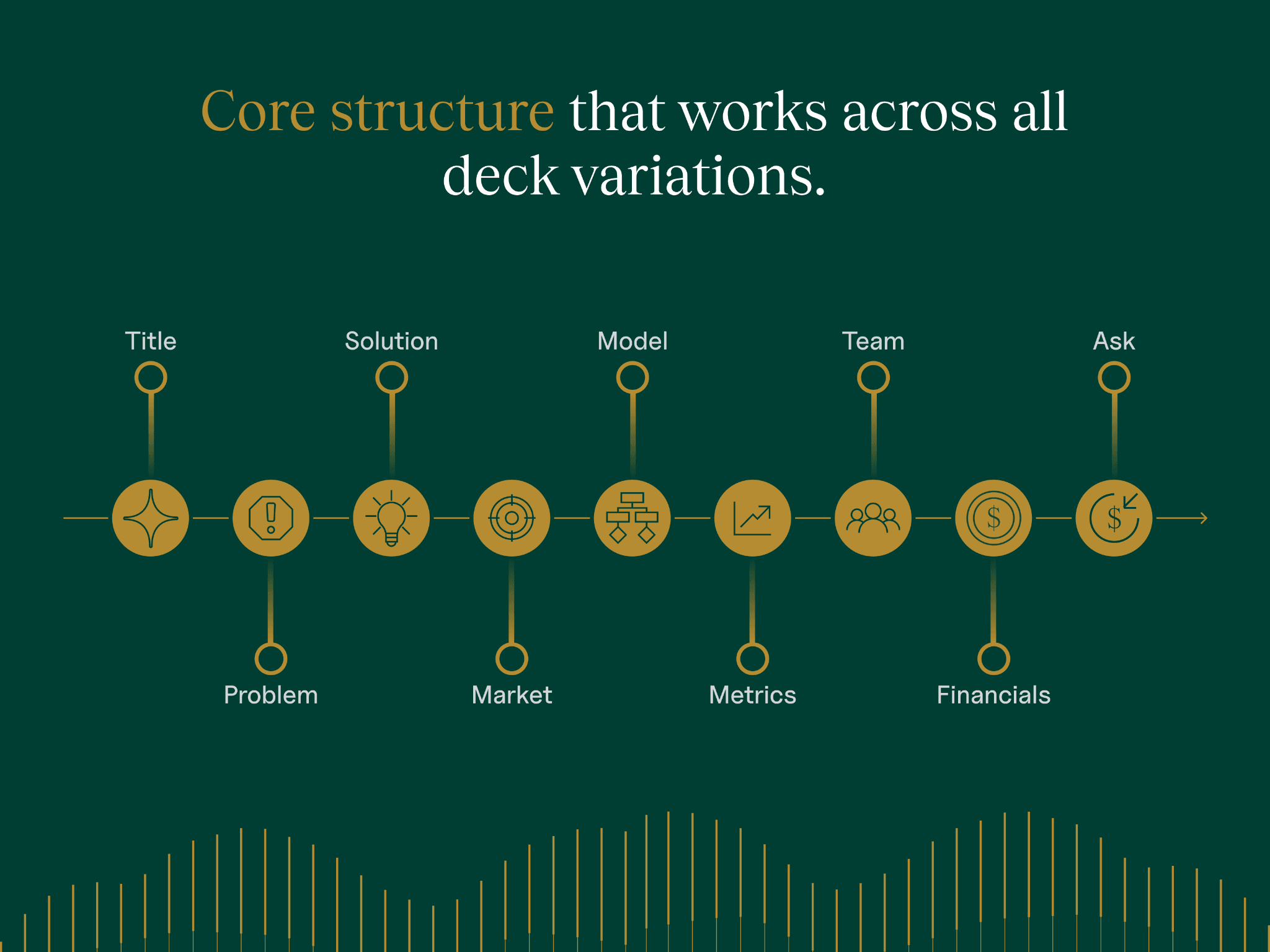

The structure that works across all deck variations

Regardless of type, every deck needs a disciplined structure that keeps information efficient and comparable. Investors prefer decks they can scan in three minutes and remember in one sentence.

The following structure consistently performs best across finance and growth contexts:

Title and executive summary: Articulate your positioning statement in one line: who you are, what you solve, and the headline number investors remember.

Problem or market gap: Define the inefficiency or risk your firm eliminates. Avoid clichés like “massive market” and focus on quantifiable gaps.

Solution or service model: Outline how your approach generates measurable results. Emphasize process, differentiation, or technology.

Market and opportunity sizing: Use verified market data. Replace TAM/SAM/SOM visuals with a segmented view showing reachable share within your channel mix.

Business or revenue model: Show exactly how revenue is earned and stabilized. Include margins, contract structure, or management fee percentages for financial services.

Performance metrics: Present historical growth, retention, or AUM evolution with quarterly intervals. Cohort data proves repeatability.

Go-to-market or distribution plan: Detail how marketing, partnerships, or sales funnels translate into measurable acquisition or conversion.

Team and governance: Showcase relevant leadership experience, oversight structure, and advisors recognized in the field.

Financial projections and capital use: Three-year model, sensitivity analysis, and how funds translate into milestones. Avoid exaggerated hockey-stick curves.

The ask or outcome sought: Be explicit about what you want, funding amount, partnership type, or strategic next step.

Supporting slides can include compliance certifications, client logos, and case summaries, all signals of trust that shorten investor hesitation.

Advanced and emerging deck variations

The digital growth deck: A newer format built for CMOs or growth executives pitching marketing investment. It showcases campaign ROI, customer acquisition cost (CAC), and lead-to-client conversion data.

The ESG or impact deck: Increasingly requested by institutional investors. PitchBook's 2025 Sustainable Investment Survey reports that 72% of investors now incorporate ESG factors into their evaluation process, with sustainable assets under management projected to exceed $40 trillion by 2030.

The regional expansion deck: Used by firms scaling internationally. It outlines market entry strategy, regulatory landscape, and localized cost assumptions.

AI-enabled deck optimization: Tools like Deckez or Pitch.com now provide analytics on which slides investors read, how long they view them, and where attention drops.

Recent research by DocSend shows that investors spend only around two to three minutes on a startup’s deck and are increasingly focused on key differentiators such as the “why now?” story, traction metrics and team composition.

Common mistakes when mixing deck types

Even experienced founders and CMOs repeat the same structural errors that weaken investor trust. The most frequent include:

Using one deck for every scenario. Audiences differ in what they evaluate. Investors care about growth rate; potential partners care about integration. Sending one static deck signals limited strategic thinking.

Treating design as decoration. Design is a cognitive filter. Inconsistent visuals, excessive text, and generic templates reduce credibility. A good deck uses negative space to direct attention and helps the investor’s memory, not just aesthetics.

Presenting unverified numbers. Investors now cross-check data instantly. Include source references and note assumptions. Omitting them suggests weak internal controls.

Focusing too much on product and too little on economics. In finance and advisory sectors, most investors already assume capability. They want to understand revenue reliability, margin pressure, and retention rate.

Overcomplicating slides. If a single chart takes more than five seconds to understand, it will not be processed in a pitch. Simplify visual layers to one message per slide.

Failing to control versioning. Sending outdated decks through multiple channels creates inconsistency. Maintain a central master version with a version code or date stamp.

Neglecting narrative pacing. Many decks lose attention by front-loading context. Begin with traction or financial impact; follow with how it’s achieved.

Ignoring risk disclosure. Counterintuitively, acknowledging controlled risks increases investor confidence. A short slide summarizing risk management often accelerates diligence conversations.

CB Insights analysis indicates that pitch decks with a sensitivity analysis around key variables receive 40% more investor follow-ups than those presenting single-scenario projections. Teams that audit their decks quarterly tend to cut average funding cycles by 25%.

The bottom line

An investor pitch deck is not a static presentation. It’s a portfolio of targeted narratives, each serving a different stakeholder and business goal.

If you manage your decks as dynamic assets, you will consistently outperform peers who rely on a single “master” file. Creating the right decks for the right opportunity enables you to communicate clearly, close faster, and project the kind of operational precision that investors trust.

Frequently Asked Questions