Private equity fundraising now rewards preparation over access. This guide shows how managers succeed by proving governance, clarity, and disciplined communication to institutional investors.

Oct 13, 2025, 12:00 AM

Written by:

Niko Ludwig

Table of Contents

Key Takeaways:

Preparation now defines success: Capital flows to managers who are ready, those with clear strategies, organized materials, and disciplined governance.

Clarity builds confidence: Investors favor funds that communicate simply and consistently across every document, from the pitch deck to the data room.

Operational excellence outweighs access: More than 70 percent of fund value creation comes from improving portfolio companies, not financial engineering.

Governance drives credibility: Transparent oversight, succession planning, and clear decision frameworks remain the strongest signals of maturity to institutional allocators.

Communication is a competitive edge: Consistent reporting, timely updates, and cohesive design across materials accelerate diligence and strengthen investor trust.

Capital is returning to private markets, but allocators are concentrating commitments among managers who demonstrate clarity, consistency, and control. Success now depends on preparation rather than access to capital.

Raising a private equity fund depends on meeting the institutional standards investors apply when deciding whom to back.

Three fundamentals define that assessment: governance, operational value creation, and clear differentiation.

Governance and risk controls. Clear decision-making structures, oversight, and compliance form the foundation of institutional credibility.

Operational value creation. More than 70 percent of expected value now comes from improving portfolio companies, not financial engineering.

Differentiation. A credible reason why your approach stands apart from managers with similar strategies.

Fundraising trends underline how critical these factors have become. In 2024, private equity funds raised 24 percent less capital than the year before, yet nearly 30 percent of institutions said they plan to increase commitments. That capital is flowing to managers who can prove they operate to these standards.

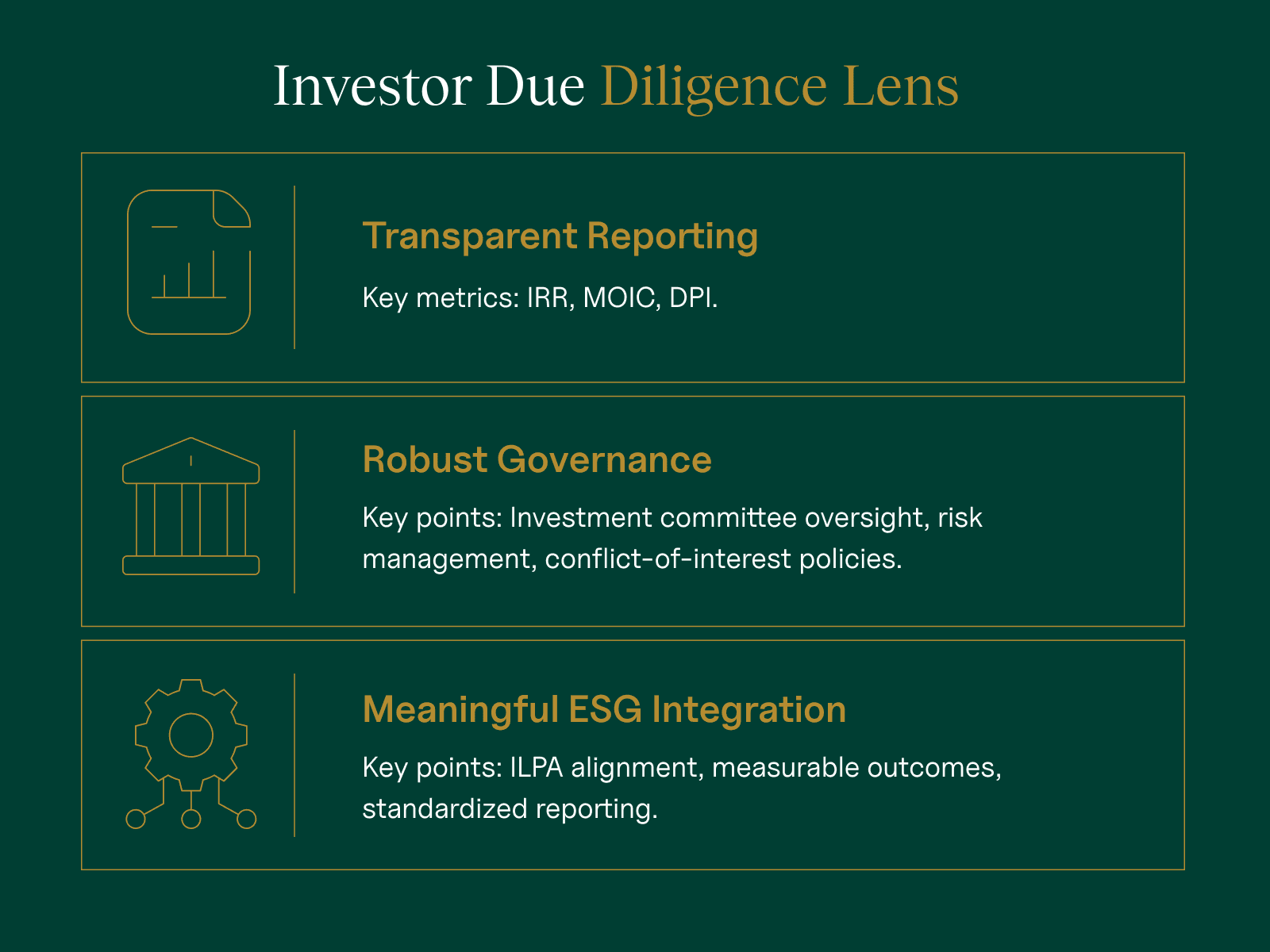

Due diligence increasingly focuses on the structures and practices that demonstrate a fund can operate at scale. Three areas are central to that assessment:

Transparent reporting: Performance metrics such as IRR, MOIC, and DPI should be calculated consistently, with clear disclosure of assumptions and peer comparisons.

Robust governance: Decision making and risk oversight must be visible, with a functioning investment committee, strong compliance, and clear conflict-of-interest policies.

Meaningful ESG integration: 88 percent of investors said they now use ESG information in decisions, yet only 3 percent rated GP reporting as excellent.

These expectations set the foundation for how capital providers evaluate a fundraise. Clarity builds confidence.

Common Private Equity Fundraising Mistakes to Avoid

Understanding what no longer works in fundraising is as important as knowing what does. Capital is concentrating with managers who operate at scale and meet institutional standards. That shift is exposing common weaknesses that often slow or derail the fundraising process.

Mistake | How Institutions Interpret It | How to Address It |

Broad or vague thesis | "Sourcing advantages" without sector depth, geographic focus, or operational specialty. | Define a clear thesis, show a real deal pipeline, and explain the edge your team has over peers. |

Misaligned economics | Complex waterfalls, hidden fees, or token GP commitments that suggest poor alignment. | Keep terms simple, transparent, and invest meaningful GP capital alongside limited partners. |

Underpowered team | Small or thinly staffed groups raise doubts about sourcing, execution, and monitoring. | Highlight operational experience, show clear role coverage, and outline plans to scale resources. |

Superficial ESG | Policy documents without measurable outcomes or integration into investment decisions. | Tie ESG to portfolio initiatives, report data consistently, and reference ILPA's framework. |

Weak data and reporting | Inconsistent KPIs, messy DDQs, or poorly organized data rooms. | Standardize metrics, update them quarterly, and align deck, PPM, and data room. |

Poor communication | Irregular updates, slow follow-ups, or silence after first outreach. | Use a CRM system, log every interaction, and maintain steady, structured communication. |

Ineffective collateral materials | Pitch decks with inconsistent metrics, missing page tags, or poorly designed supporting materials. | Ensure all materials are consistent, accurate, and professionally presented with clear page tags and navigation. |

Don’t let avoidable errors be the reason you lose deals.

Building a Competitive Edge

Presenting a thesis that is broad, unfocused, or difficult to evaluate is the fastest way to lose attention during diligence. A clear and well-defined strategy helps institutions understand where you compete, how you create value, and why your approach stands out in a crowded market.

Clarify your investment thesis and sector focus

A differentiated thesis connects directly to what evaluation teams are looking for. It should make clear the market you focus on, the opportunity you see, and the insight that gives your team a genuine advantage.

Sector focus: Articulate where you'll compete and why your understanding of market dynamics, buyer behavior, or regulatory landscape gives you an edge.

Geographic scope: Which regions you cover and how your local networks or regulatory knowledge create an advantage.

Value creation approach: Whether through operational transformation, technology adoption, or sector-specific expertise, articulate how you'll generate returns beyond financial engineering.

Align fund size and track record with team capacity

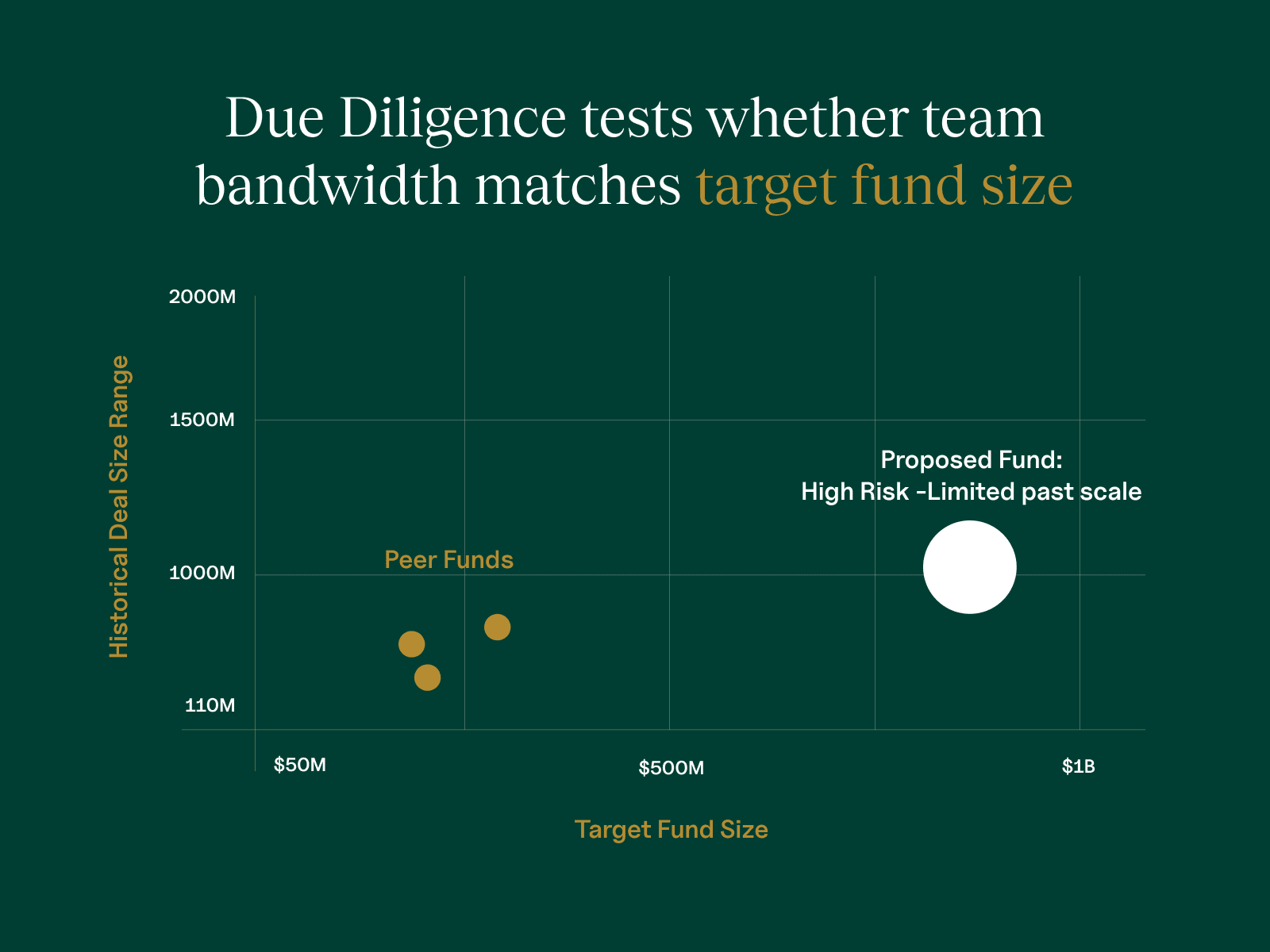

Due diligence tests whether a target fund size reflects the manager's ability to deploy capital effectively. Review teams want to know if the sourcing pipeline and team bandwidth can support the number of deals implied by the fund.

In fact, over 80% of PE funds closed at a larger size than their predecessor fund, the highest rate ever seen for the asset class and surpassing the five year average of 73.1. Growth has become the norm, but capital only flows to increases that are backed by a track record and a team that can execute at a higher level.

Past experience concentrated in $50 to $100M deals raises immediate concerns when paired with a proposed $1B fund, unless sourcing and oversight plans show how execution will expand.

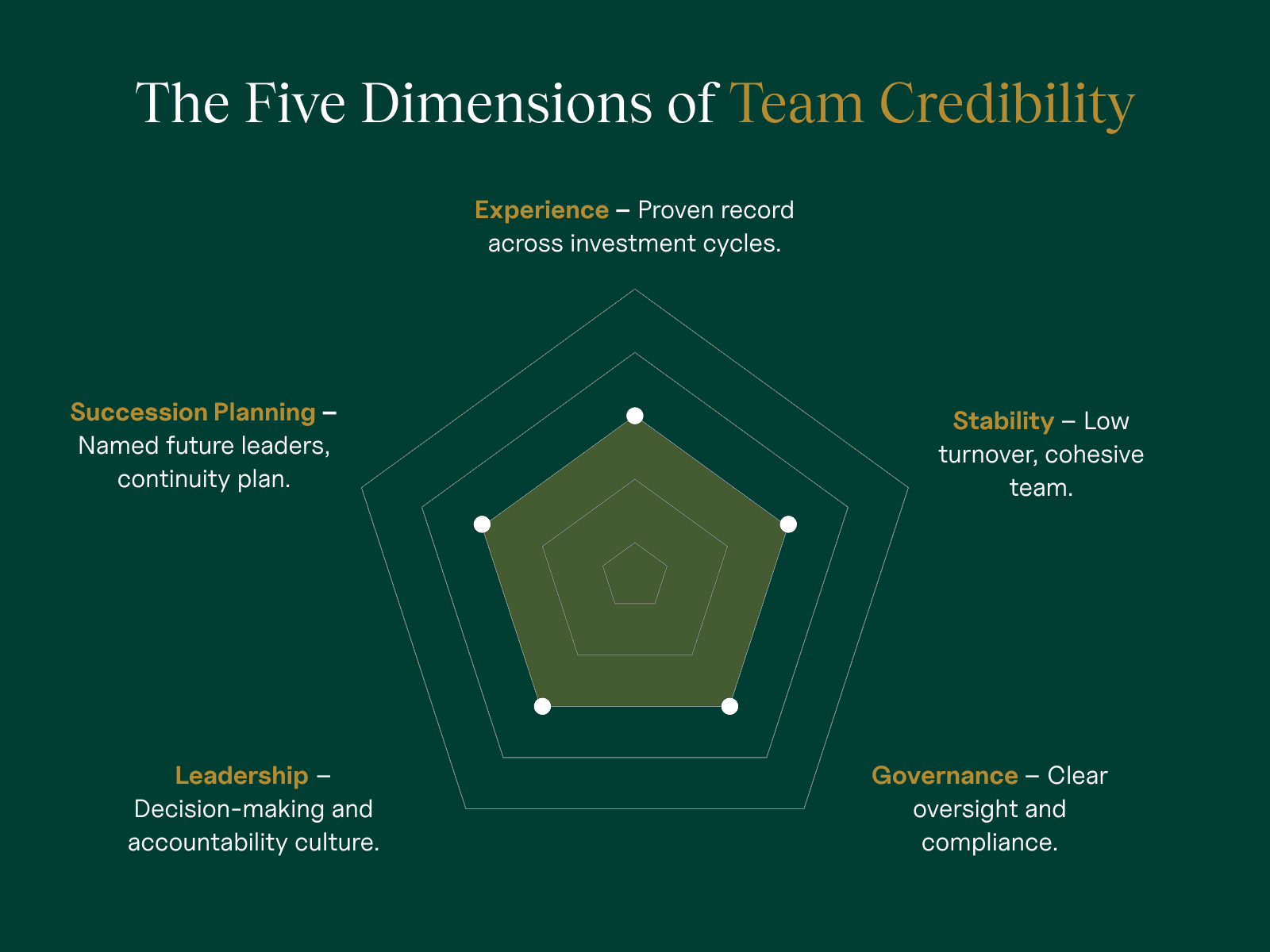

Building team credibility

Team credibility often determines whether institutions will underwrite a strategy and commit capital, even more than past performance.

Individual experience and visibility

Diligence teams now evaluate managers through the same lens used for established institutions. Clarity of strategy, transparency in reporting, and evidence that governance and oversight are firmly in place define that evaluation.

Team cohesion and stability

Research shows that 68 percent of capital providers prioritize team tenure and continuity when evaluating managers. High turnover signals instability. Overreliance on a single partner to source and execute deals is treated as a structural red flag.

A balanced team with complementary skills and a proven history of collaboration across investment cycles signals stability and cohesion.

Succession and governance

ILPA considers succession planning a critical marker of maturity, particularly for firms that rely on founding partners nearing retirement. In practice, Limited Partner Advisory Committees can suspend commitments or invoke key person provisions after departures that materially weaken the team.

Showing a clear succession plan and naming future leaders indicates continuity and reduces perceived risk around key-person dependency.

Leadership and culture

According to ILPA surveys, 45 percent of evaluation teams consider leadership quality more important than returns when selecting managers.

Leadership includes decision-making processes, accountability frameworks, and the ability to attract and retain talent. Firms that articulate their culture and show how it shapes investment behavior gain credibility with backers who recognize that team dynamics drive long-term outcomes.

A strong team does not just support a strategy. It determines whether that strategy is investable.

Fund Structures Investors Trust

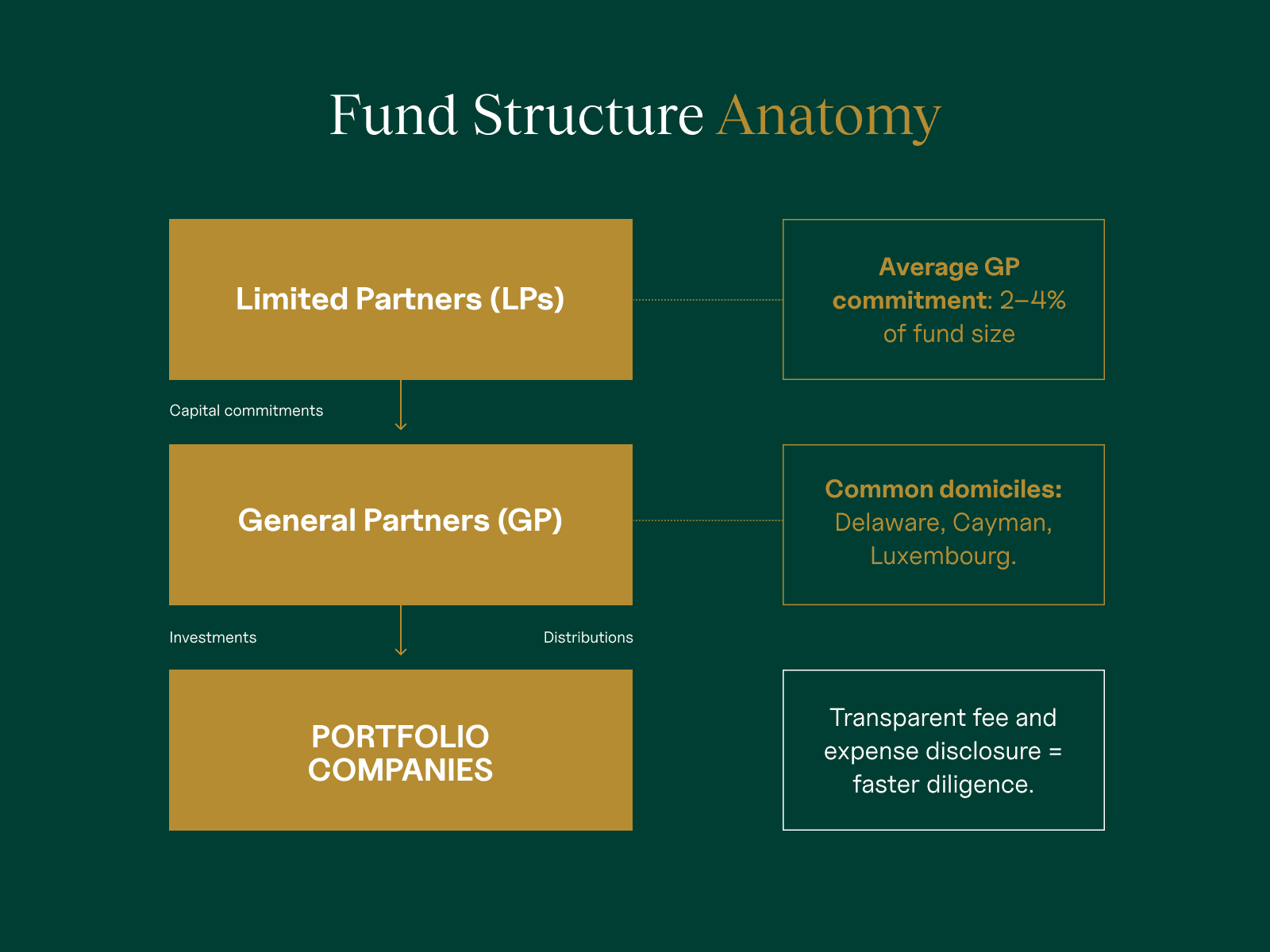

Funds with transparent structures move through diligence faster when institutions recognize them as simple, aligned with investor interests, and familiar.

Alignment of terms

According to an ILPA survey, 51 percent of capital providers rank clear fee and expense disclosures as a top priority. Yet 97 percent of review teams report that the starting point of fund terms tends to favor GPs, and 87 percent say that final terms often still tilt in the GP's direction.

Managers who present straightforward economics, without unnecessary complexity, reduce friction in diligence.

GP commitment

Skin in the game remains one of the most visible signals of alignment. Data from UNC and StepStone covering more than 1,500 funds shows an average GP commitment of 3.5 percent of fund size and a median of 2 percent.

Buyout funds average closer to 3.9 percent, while venture and growth strategies are typically nearer 2.3 percent. Commitments that fall meaningfully below these benchmarks raise questions about conviction and alignment.

Legal structure and domicile

The legal framework matters as much as the economics. Most institutions favor familiar domiciles that are tax efficient and regulatorily sound. Delaware partnerships remain the standard for US funds, while Cayman and Luxembourg are increasingly used for cross-border structures.

Parallel Cayman-Luxembourg vehicles are increasingly used to accommodate global investors.

Investor Marketing Materials and Due Diligence

Review teams will not parse messy decks or scattered data rooms. Consistent materials are the baseline for serious fundraising. For most allocators the first meeting now happens on your website and in your deck. Stakeholders form early judgments within the first minutes of the visit.

Once you've defined your strategy and terms, your ability to raise capital depends on how clearly you communicate them. Once terms are set, the next challenge is communication: how those structures are presented and understood. Evaluation teams expect concise, well-structured materials that tell a consistent story and make diligence straightforward.

Develop clear positioning and narrative

Your positioning should explain in plain terms what you invest in, why your team is qualified, and how you create value.

The strongest narratives tie your thesis, track record, and operational approach into one coherent story. Avoid buzzwords and vague claims. Institutions want specificity they can test against their own mandates.

Build essential materials for due diligence

At a minimum, you need:

PPM: Audited track record and risk disclosures.

Pitch deck: Consistent narrative and evidence.

Data room: Indexed, current, and aligned with the deck.

Website: Professional, current, and consistent with fundraising materials, since review teams often examine it before first meetings.

For institutional capital providers, you should also prepare:

Fund one-pager: A concise overview that can be circulated internally.

DDQ (Due Diligence Questionnaire): Standardized disclosures on governance, compliance, and ESG.

Detailed track record schedules: Realized and unrealized performance at the deal level.

Each item should align on facts, terminology, and numbers. Evaluation teams cross-check documents, and inconsistencies are an immediate red flag. Anticipating the information they'll request, from governance policies to ESG disclosures, reduces uncertainty during diligence and shortens evaluation cycles.

How to Find and Target the Right Investors

Fundraising momentum depends on focusing outreach on the institutions that best match your strategy, structure, and scale.

Investor types

Institutional allocators such as pensions, endowments, and sovereign wealth funds write the largest checks but require the most rigorous diligence. They expect audited track records, formal governance, and multiple years of performance data.

Family offices and private wealth channels move faster and can take earlier risks, especially if they believe in your team. They value direct access and often look for flexible co-investment opportunities.

Consultants and funds-of-funds act as influential gatekeepers. Winning their support can unlock a broader investor base, but their processes are highly structured and criteria stringent.

Geographic Considerations

North America is familiar with Delaware partnerships and standard fee structures, but competition for allocations is intense.

Europe leans toward Luxembourg and Irish domiciles, with ESG reporting scrutinized under regulatory frameworks such as SFDR.

Middle Eastern sovereigns often favor larger funds and clear co-investment rights, though some also pursue niche strategies where governance and alignment are strong.

Asia adds complexity through diverse local tax and regulatory regimes, where partnerships with regional institutions can be decisive.

Practical Steps to Prioritize Outreach

Start with capital providers whose mandates match your fund size, geography, and strategy. Public disclosures, databases, and ILPA membership lists are effective filters.

Sequence outreach by profile: institutions often require warm introductions or placement agents, while family offices are more likely to engage directly.

Track interest signals such as increased allocations to your asset class or those backing first and second-time funds. These are often the institutions most open to new conversations.

By combining investor segmentation, regional awareness, and a clear prioritization process, you avoid wasted conversations and focus on backers most likely to move through diligence.

The Fundraising Process Step by Step

Fundraising unfolds in three phases. How you manage each one determines whether you demonstrate readiness or risk. Each stage should build on the last, keeping your story consistent and your process organized.

Steps 1 to 3: Preparation

The early stage shapes how evaluation teams perceive you. It's where you refine your thesis, align materials, and prepare before a single meeting.

Step 1: Define your investment thesis and target fund size

Show how your experience, network, and focus align with the opportunity. Evidence-based strategies secure commitments; ambition without proof does not.

Use data that demonstrates substance:

Use market intelligence to define the addressable opportunity

Use competitor benchmarks that prove differentiation

Use TAM analysis that supports your fund size

Step 2: Draft your core documents

Your materials must read as one coherent narrative. Prepare the PPM, pitch deck, and term sheet in parallel so every number, chart, and definition aligns.

The PPM should include audited track record and risk disclosures.

The pitch deck should present your strategy, team credentials, and evidence of value creation.

The term sheet should outline economics and governance in plain language.

Mismatched figures across documents are one of the quickest ways to lose credibility.

Step 3: Build and index your data room

Organize audited performance data, governance policies, and ESG disclosures in a clear folder structure. Label and index everything so information is easy to locate. Keep files current and remove outdated materials that could slow diligence.

Steps 4 to 6: Execution

This phase turns interest into commitments. How you manage meetings, follow-ups, and negotiations determines who advances to due diligence.

Step 4: Identify and prioritize the right allocators

Research before outreach.

Review:

Investment mandates and allocation priorities

Historical capital flows by strategy and vintage

Regional preferences and regulatory constraints

Prioritize institutions whose mandates match your strategy.

Step 5: Lead investor meetings with clarity

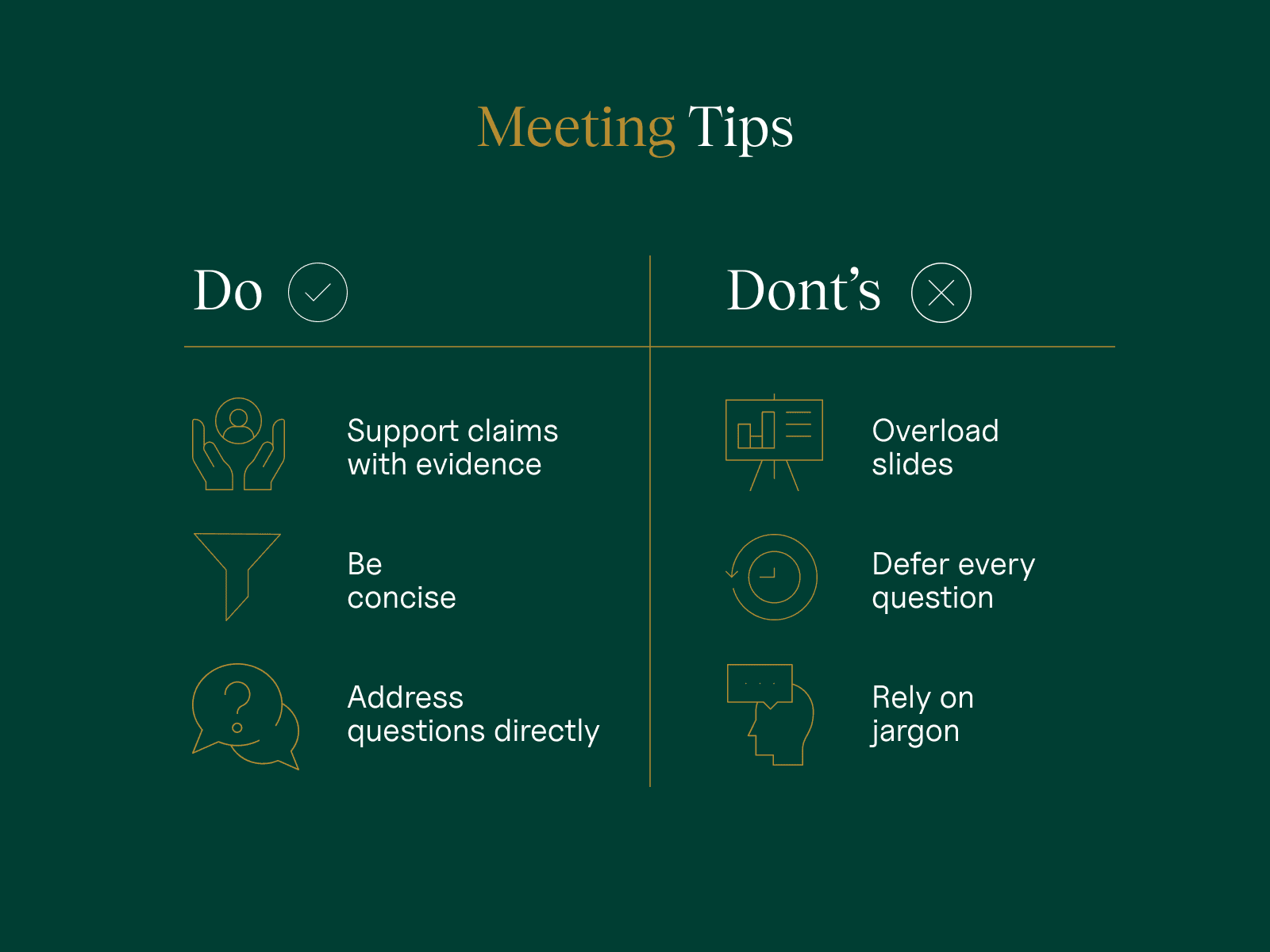

Explain how your strategy differs from your peers and support it with evidence. Use data and case examples, not jargon. Address questions directly rather than deferring to follow-up materials. Meetings test clarity and conviction in real time, and clear articulation matters more than post-meeting slides.

Step 6: Negotiate and refine

Use market data to validate your terms. If the same concern is raised multiple times, treat it as a structural issue rather than handling it in isolated discussions.

Keep a version-controlled record of agreed changes so updates stay consistent across all materials.

Steps 7 to 8: Closing

The final stage secures commitments and sets expectations for reporting and communication. Precision here protects you long after the raise ends.

Step 7: Finalize agreements and commitments

Align every document (legal, financial, and operational) before signing. Coordinate timing so all institutions at the same stage receive identical information. When one participant receives updated terms or data, share them with every institution in that round.

Step 8: Launch reporting and capital calls

ILPA recommends quarterly reports within 45 to 60 days for unaudited results and 75 to 90 days for audited results. Fund-of-funds typically receive an additional 30 days.

New ILPA templates introduced in 2025 will standardize disclosures beginning in early 2026. Align your reporting systems now rather than retrofitting later.

Maintain consistent methodologies and benchmark against peer funds with similar strategies and vintages. A clear reporting cadence from day one gives stakeholders predictable visibility into performance.

Following a structured process keeps fundraising efficient and ensures each stage reinforces the next.

Bottom Line

Private equity fundraising has become a test of preparation. Evaluation teams expect managers to present a clear strategy, coherent materials, and evidence of control across every stage of the process. When these fundamentals are in place, conversations move faster and diligence becomes easier to navigate.

Most fundraising setbacks come from avoidable gaps: inconsistent data, unclear messaging, or materials that do not reflect institutional standards. Addressing these details early shortens diligence cycles and accelerates closing, sustaining confidence through the raise and beyond.

Frequently Asked Questions