Discover how allocators assess managers in the first moments of reviewing materials. These strategies reveal what signals strengthen your position before diligence begins.

Dec 2, 2025, 12:00 AM

Written by:

Niko Ludwig

Table of Contents

Key Takeaways:

Credibility forms before performance is reviewed. Early signals in structure, clarity, and tone determine whether allocators choose to continue evaluating you.

Sequence information the way allocators think. Leading with risk, context, and execution logic resolves skepticism before you present returns.

Treat risk as a mark of professionalism, not a disclaimer. Specific downside scenarios and mitigation plans build more trust than broad warnings.

Design materials for each stage of the investor workflow. Screening decks, IC presentations, and executive summaries require different levels of depth and emphasis.

Guide allocator attention with selective disclosure. Highlight representative deals and repeatable processes rather than overwhelming them with undifferentiated data.

Allocators are pattern-recognition machines. Long before they scrutinize your attribution tables, they’re evaluating your judgment through the structure, clarity, and tone of your materials. It’s an unspoken filter, determining who advances and who doesn’t.

The key is in how you architect perception through strategic communication choices that allocators reward. Managers often match top-tier performance but can lose allocations because they misunderstand what drives investor confidence before a single return metric gets scrutinized.

These early credibility signals aren’t random. They follow a predictable pattern that top managers use deliberately. The following sections break that pattern into a clear strategy framework—showing how structure, sequencing, risk framing, and communication design collectively shape allocator decisions long before performance is reviewed.

Research from Preqin's LP survey data consistently shows that allocators make preliminary judgments within the first 90 seconds of reviewing materials. According to Institutional Investor's annual LP survey, communication quality ranks among the top five factors in manager selection, often weighted as heavily as team experience.

These assessments are based on pattern-recognition built from evaluating hundreds of managers. Allocators use communication quality as a leading indicator for operational strength, reasoning that firms who control their narrative likely apply similar rigor to portfolio management.

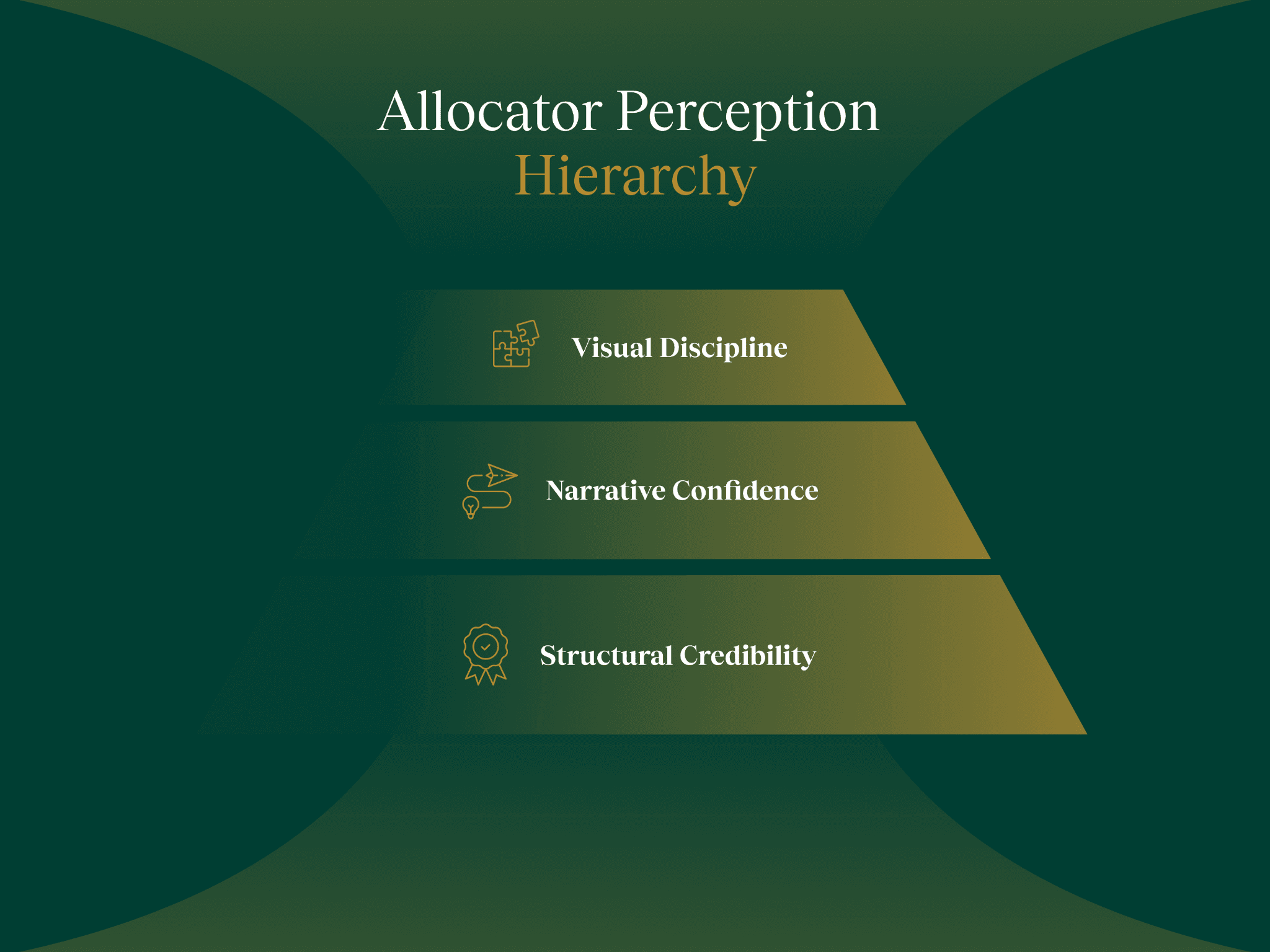

A handful of early signals shape these initial judgments

Structural credibility

Structural credibility reflects how information gets organized. Top managers structure materials to match allocator workflow, not their own internal logic. A deck organized by investment thesis, then risk framework, then track record signals strategic thinking. One organized by company history, then market overview, then "our properties" suggests promotional mindset rather than analytical discipline.

Narrative confidence

Narrative confidence appears in how firms frame risk and opportunity. Present investment logic as thesis-driven rather than opportunity-reactive. Acknowledge what could go wrong before projecting what should go right. You will stand out from materials that often reverse this sequence, leading with upside potential and relegating risk to compliance-mandated disclosures buried in appendices.

Visual discipline

Visual discipline serves as an operational proxy. ILPA's transparency standards show that consistency across investor touchpoints signals systems thinking. Research from Deloitte's Alternative Fund Manager survey found that 73% of institutional allocators cite "professional presentation quality" as a proxy indicator for operational maturity.

When a fund's pitch deck, follow-up emails, data room, and quarterly letters maintain coherent terminology and visual standards, allocators infer operational consistency. Inconsistent materials with mixed fonts, switches between formal and casual tone, and different performance calculation methodologies raise questions about back-office discipline.

Terminology consistency

Define key terms once (e.g., how they calculate "value-add returns" vs. "core returns") and use those definitions consistently across all communications. Don’t use terms loosely, saying "stabilized" in one context and "core" in another when they mean the same thing, or calculating IRR differently for different vintage years.

Consistency in response

Maintain consistent tone and structure even in informal communications. Their two-paragraph email answering a diligence question has the same analytical rigor and precise language as their formal presentations.

This doesn't require expensive rebrands or design agencies. It requires documented standards and discipline to follow them. Many top firms use relatively simple design systems and apply them religiously across every investor interaction.

The consistency principle extends to how firms discuss performance. Top managers use the same attribution framework in pitch decks, quarterly letters, and conversations. They don't emphasize different metrics depending on which looks best in a given period. This builds trust because allocators can track how you think about your own performance over time.

One tactical note: consistency doesn't mean rigidity. You can update your frameworks as your strategy evolves, but explain changes explicitly rather than quietly shifting without acknowledgment. "We're now reporting gross and net IRR separately because our LP base requested it" maintains trust. Silently changing calculation methodology between reports erodes it.

Seen together, these early signals form a pattern. In the next sections, we turn them into four practical strategies you can apply to your own materials.

Successful firms structure evidence in order of skepticism resolution, not chronological or categorical logic. This is where structural credibility shows up in practice: the way you order information to match how allocators think, not how your firm is organized. They've mapped the typical allocator evaluation sequence: Can they protect capital? Can they generate returns? Do we trust them? Materials that answer these questions in sequence have a better chance of converting than those organized around firm history or market opportunity.

Allocators spend an average of 12 minutes on initial deck review before deciding whether to advance a manager to the next stage. This compressed timeline rewards materials that front-load credibility signals rather than materials that work up to them gradually.

A well-structured pitch deck begins with candid risk and execution-context analysis, not glossy upside charts. Institutional-grade deck guidance recommends that the earliest pages should:

highlight zoning constraints,

permit-timeline uncertainty,

construction cost volatility,

and other project-specific or market risks, before diving into pro-formas and projected returns.

This upfront transparency signals discipline and realism. By contrast, a more typical “opportunity-first” sequence with market growth statistics, demographic trends, size of the opportunity, and a cursory nod to risk tends to trigger allocator skepticism: “They’re selling potential without proving they can deliver.”

This sequencing advantage compounds through each section. Top funds present market expertise before track record because allocators need context to interpret performance. Cambridge Associates' research on manager evaluation found that investors assess strategy credibility before performance credibility. They want to understand how you generate returns before evaluating whether you've generated them.

Answer skepticism with confidence, concisely

Showing you understand local market dynamics (supply constraints, demand drivers, competitive positioning) makes your 22% IRR credible. Leading with the 22% IRR could make some allocators wonder if you got lucky.

Confident firms also accept the constraint of having to get their point across in a maximum of 10-12 slides and structure them to preemptively address skepticism. Other managers fight it, cramming 28 slides into the deck and rushing through the back half when allocators check their watches.

The proof sequencing principle extends beyond decks. Successful managers structure live pitches, follow-up materials, and diligence responses using the same skepticism-resolution logic. When an allocator asks about downside protection, top funds don't just answer the question, they demonstrate that they've already stress-tested the scenario and built contingency plans.

After credibility is sequenced through structure, the next credibility strategy comes from how managers discuss uncertainty itself. Once the foundation of proof is set, allocators look for evidence of realism, and that’s revealed through how risk is framed.

Strategy 2: Risk framing as your competitive advantage

Some managers treat risk disclosure as a compliance obligation. You can use it as a differentiation. Some funds bury risk factors in legal disclaimers or appendix slides titled "Risk factors" that read like boilerplate. To be more effective, open with sections labeled "What could go wrong" or "How we protect capital" to demonstrate that you’ve thought everything through and built mitigation strategies.

ILPA's reporting guidelines show that institutional allocators expect sophisticated risk discussion. A 2024 survey by Institutional Limited Partners Association found that 89% of LPs view upfront risk discussion as a positive indicator of manager competence, yet only 34% of emerging fund managers lead with risk frameworks. The difference lies in positioning.

Three risk-framing approaches separate quality materials from standard disclosure:

Preemptive mitigation

This shows that you've identified potential failures and designed operational safeguards. Instead of listing risks abstractly ("market downturns may impact returns"), explain specific scenarios and their response protocols ("if cap rates expand 100 basis points, we maintain 18-month liquidity reserves and can defer non-critical capex to preserve distributions").

Comparative context

Position your risk profile against a peer set. Data from PitchBook's quarterly analyses helps funds demonstrate their leverage ratios, concentration limits, or sector exposures relative to market. Bain & Company's Global Private Equity Report provides additional peer comparison frameworks. This transforms risk from absolute concern to relative positioning.

Historical resilience

Use past stress periods to demonstrate how you navigate adversity. Confident managers don't just show performance during bull markets. They highlight Q4 2018, March 2020, or regional downturns specific to their markets, explaining how they protected capital when others didn't.

Why do some firms avoid leading with risk? Fear of "talking ourselves out of a deal." However, most allocators are more interested in evaluating whether you know the risks and have systems to manage them. Acknowledging vulnerability from a position of preparedness builds trust. Avoiding it until questioned suggests either naivety or evasion.

One caveat: risk framing requires substance, not theater. Allocators distinguish between managers who've genuinely stress-tested their models and those who've added a "risk management" slide to check a box. The difference appears in specificity because the more successful funds cite actual scenarios, quantify exposures, and explain decision rules. Generic statements about "rigorous risk management" or "comprehensive due diligence" signal the opposite of what they intend.

Strategy 3: Design for the investor experience (not just presentation)

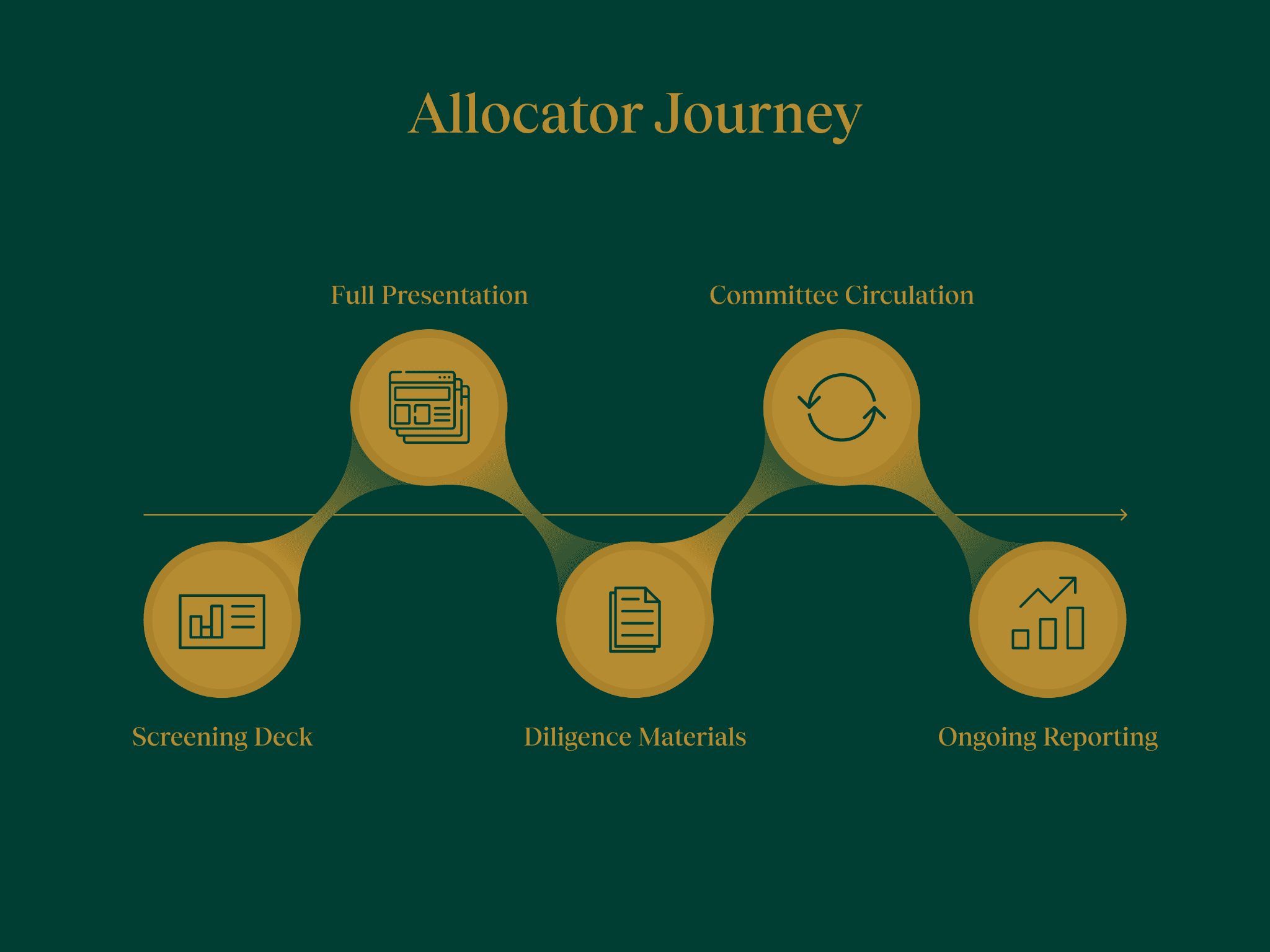

Successful firms map materials to allocator workflow to fit what gets reviewed when, by whom, in what context. This produces fundamentally different communication architecture than the standard "one deck fits all" approach.

Successful fundraises typically involve an average of 4.3 different document types tailored to specific decision stages, compared to 1.8 for funds that struggle to close.

For a private equity firm, this could look like three versions of their investment materials:

a 10-slide screening deck for initial LP conversations,

a 35-slide full presentation for investment committee review,

and a 4-page executive summary designed for board circulation.

All contain the same underlying strategy and performance, but each version is optimized for different decision stages and audiences.

The screening deck should focus purely on differentiation: What makes this fund different from the 40 other PE opportunities this allocator is evaluating? Include:

one track record slide (key metrics only),

one strategy slide (specific edge),

and one team slide (relevant experience).

No market overview, no exhaustive deal-by-deal breakdown, no 5-year financial projections. Just signal strength compressed into materials an allocator could review in a few minutes and decide whether to advance.

What to include in a full presentation

The full presentation should provide depth for serious evaluators:

detailed case studies

comprehensive performance attribution

operational playbooks

and risk scenarios.

This version assumes that the allocator had already decided the fund was interesting and now needed ammunition to convince their IC.

The executive summary translates investment logic into language that resonates with non-specialist board members or consultants who influence but don't lead diligence. (This matters because Research from the CFA Institute on investment committee dynamics shows that non-specialist members influence 60% of allocation decisions despite leading less than 15% of detailed diligence.) It emphasizes governance, alignment, and precedent ("similar to the Carlyle fund we allocated to in 2019") rather than technical strategy details.

While it may be easier to aim for one comprehensive deck that "covers everything," it often results in materials that are:

too detailed for initial screening,

too shallow for diligence,

and too technical for executive circulation.

Recognize that allocators use materials differently at different stages and design accordingly.

3 Additional items that will help you stand out

One-pagers designed for forwarding

Materials optimized for an allocator to send their IC with a note saying "this looks interesting." These compress core thesis, risk mitigation, and performance into a single-page format that respects the IC member's time.

Detailed appendices that don't interrupt the main narrative.

Technical details, full deal lists, model assumptions, and legal structures available on request but not cluttering the primary presentation. This lets different audiences go as deep as they need without forcing everyone through the same level of detail.

Follow-up materials that reinforce (not repeat) live pitch.

Post-meeting recaps that deepen specific areas that generated questions rather than summarizing what was already discussed. Listen for what resonated and what raised concerns, then provide targeted follow-up addressing those precise points.

Strategy 4: Control the narrative through selective disclosure

Don't tell allocators everything, rather guide their attention strategically. The distinction isn't between transparency and opacity but between showing methodology versus showing everything.

If you run a fund with 15 portfolio companies, for example, don’t dedicate one slide per company. Instead, highlight three investments in depth as representative examples: one demonstrating market expertise, one showing operational capability, and one illustrating risk management. Then provide a summary table with key metrics for the full portfolio.

This approach signals confidence (you know which deals best demonstrate your capabilities) rather than uncertainty (showing everything and hoping something resonates).

Balancing depth with substance in your materials

According to NACUBO’s endowment allocation studies, depth beats breadth for credibility. "Show me you know what drives performance, not that you have data" captures the principle. Excellent materials demonstrate analytical strength through representative examples that illustrate broader competencies. Standard materials list everything, leaving allocators to identify patterns themselves.

The balance point requires including enough detail to demonstrate substance, but not so much that you obscure insight. A track record section with 28 deals and 12 columns per deal (entry date, exit date, equity invested, debt raised, capex deployed, NOI growth, occupancy change, exit cap, gross IRR, net IRR, equity multiple, hold period) makes allocators work to find the signal. One showing five representative deals with narrative explaining what each demonstrates, plus a summary table with key metrics for the full portfolio, guides them to your strengths.

You can exemplify this through strategy disclosure. Be precise about investment logic (how you identify opportunities, what edge you exploit, how you size positions) but selective about current positions. This satisfies the allocator's need to understand your methodology without compromising strategy execution or raising front-running concerns.

Process transparency is more important than position transparency.

The selective disclosure principle applies to risk discussion as well. Don't list every conceivable risk. Identify the three to five most material risks, explain their mitigation approaches, and acknowledge residual exposure. This demonstrates judgment about what matters rather than comprehensive paranoia.

However, there is one critical distinction: selective disclosure isn't selective truth. Don't omit material information or misrepresent performance. Curate what gets emphasis based on what best demonstrates your capabilities. When allocators ask about areas not highlighted, provide thorough answers instead of attempting to lead with everything simultaneously.

Can an allocator finish reviewing your materials and articulate your core differentiation in two sentences? If they can, you've guided attention effectively. If they finish confused about what makes you different, you've probably overwhelmed them with undifferentiated information.

How to evaluate your materials

Most firms have decent materials but lack strategic communication frameworks. The gap is in understanding allocator decision psychology. Successful, strategic communication is built on mapping how allocators actually evaluate managers and structuring materials to match that evaluation sequence.

Here are five diagnostic questions to evaluate your current materials:

1. Does your proof sequence match allocator logic?

Check your deck’s flow. Does it answer “can they protect capital?” before “can they generate returns?” and establish expertise before showing results, or do you follow your own internal order?

2. Do you present risk as competence or compliance?

Review how you discuss downside scenarios. Is risk framed upfront as analytical discipline, or buried in the appendix as a checkbox?

3. Are materials built for how allocators actually use them?

Map every touchpoint: email, deck, data room, quarterly letters. Does each piece reinforce a consistent story at the right depth, or repeat one-size-fits-all content?

4. Does consistency signal operational excellence?

Compare terminology, visuals, and metrics across materials. Are calculations identical everywhere or do small inconsistencies suggest improvisation?

5. Do you guide attention or drown it?

In your track record section, do key strengths surface clearly, or must allocators hunt for them? Could half the slides tell the same story better?

These are strategic positioning choices. The firms winning allocations most efficiently aren't always performing best. They're structuring how their performance gets understood.

Closing credibility gaps requires diagnosing why your materials fall short (not just that they do) and implementing strategic frameworks (not just design upgrades). Positioning advantage emerges from understanding allocator psychology and architecting communications accordingly.

The bottom line

Perception management is the art of structuring how reality gets understood. The difference between "professional" and "institutional" lies in strategic choices about proof sequencing, risk framing, experience design, consistency, and attention guidance that allocators may not consciously recognize but consistently reward.

Use a framework that crafts a compelling perception of your strategy and capability ahead of your performance records, in line with allocator decision psychology, and you’ll close the gap successfully. The firms that control perception, control allocation.

Frequently Asked Questions