Learn how weak collateral quietly increases the cost of every fundraise. Discover why institutional-grade materials restore momentum, protect fees, and strengthen allocator confidence.

Dec 5, 2025, 12:00 AM

Written by:

Niko Ludwig

Table of Contents

Key Takeaways:

Poor collateral creates a measurable fundraising tax. Every clarity gap slows allocator progress, increases touchpoints, and extends timelines that quietly drain partner hours and management fees.

Clarity is the allocator’s first filter. Weak materials immediately shift LPs into a decline mindset long before performance enters the conversation.

Institutional collateral compresses your cost of capital. Standardized data, clean structure, and allocator-ready framing shorten the path from first meeting to diligence and reduce the number of clarification cycles.

The ROI of professional materials compounds across fund cycles. Once a firm builds standardized, allocator-ready collateral, future raises, DDQs, and reporting move faster and require fewer senior partner hours, creating lasting operating leverage.

Fundraising is a test of perception and performance. Even top-performing GPs underestimate how much collateral determines fundraising speed, but institutional allocators quietly judge something else first: the quality of your collateral. Weak materials can extend timelines, drain partner hours, and erode credibility long before performance even enters the conversation.

In an era of intensified due diligence and investor selectivity, every clarity gap or formatting flaw compounds into measurable cost. This article quantifies the hidden costs of underperforming investor materials in lost time, deferred fees, and missed opportunities, and reframes collateral as a fundamental operating system for capital formation.

The most immediate impact of poor collateral is friction. Each gap in clarity forces allocators to fill in blanks, and in a crowded market, few have time or patience to do so. According to the Preqin Global Private Capital Report (2025), average fundraising cycles have lengthened materially since 2020, in some strategies approaching two years by mid-2025. This kind of delay translates into three measurable forms of loss.

These costs appear in three areas every GP feels but few quantify:

1. Partner time

Senior partner time is the most valuable and least scalable resource in a firm. Redundant meetings or clarification calls siphon hours away from sourcing, diligence, or portfolio work, and those hours can cumulatively translate into millions of dollars. A partner billing equivalent time at $2,500 an hour who spends 100 unnecessary hours explaining poorly structured data effectively loses a quarter-million dollars of labor value per fundraise.

This partner-time tax rarely appears on financial statements, but it directly affects deal velocity. The connection between wasted partner hours and deal velocity operates through a brutal resource constraint: senior partners are the ultimate bottleneck in any investment firm. When they spend hours clarifying poorly structured materials—explaining track record methodologies or restating investment theses—they're unavailable for activities that actually advance deals: sourcing opportunities, conducting diligence, or cultivating high-priority LP relationships.

This creates exponential loss. Every hour in a clarification meeting is an hour not spent advancing conversations with multiple other allocators, attending conferences where deal flow originates, or conducting preliminary diligence on prospective investments. Poor collateral breaks fundraising momentum by forcing the process into reactive mode, creating a stop-start pattern that kills the psychological momentum driving allocators toward commitment.

In quantitative terms: firms with institutional-grade materials typically advance from initial pitch to LOI significantly faster than those requiring extensive clarification. While timelines vary by asset class and investor type, funds with strong collateral often move from initial pitch to serious diligence in a few months, while firms with poor collateral can take much longer for the same progression due to repeated explanation cycles.

GPs who invest in institutional-quality decks report fewer clarification meetings, higher allocator conversion rates, and more time to pursue new LP relationships. Recent LP surveys show that operational readiness and clarity of reporting materially influence allocation decisions because presentation quality is one of the practical proxies allocators use to assess a manager’s competence and readiness.

The meeting multiplication effect

The true cost extends beyond individual meetings to the entire decision architecture. When materials fail to preemptively answer standard questions, allocators default to conservative interpretation. This triggers a cascade: the investment committee requests additional data, the chief investment officer schedules a follow-up, the analyst must brief multiple internal stakeholders separately because the deck doesn't speak for itself.

Industry data suggests that funds with weak collateral require significantly more touchpoints to reach commitment than those with institutional-grade materials. Limited partner surveys from organizations like ILPA and Private Equity International consistently indicate that clarity of presentation materials is a factor that significantly influences their decision to advance managers from initial screening to formal due diligence.

Each additional meeting isn't merely additive, it's multiplicative. The preparation time, internal alignment discussions, and post-meeting follow-up mean that a single "quick clarification call" actually consumes 6-8 hours of cumulative team time when properly accounted for.

This multiplication effect also introduces timing risk. Every postponement creates an opportunity for competitive displacement. While your team schedules the next clarification meeting, an allocator may advance a competing fund with clearer materials into due diligence. In institutional allocation decisions, momentum compounds advantage. The fund that reaches the investment committee first often wins the allocation, regardless of marginal performance differences.

2. Management fee leakage

Fundraising delays defer the revenue stream that keeps a management company operating. A $100 million fund charging a 2 percent management fee generates about $166,667 per month once fees begin. A 6 month delay pushes back roughly $1 million in expected fee income that would otherwise support staff, compliance, and portfolio oversight.

This pressure compounds because delayed closings also delay the start of capital deployment. The team remains fully active managing outreach, diligence, and reporting, but fee inflows remain on hold, tightening liquidity precisely when operating demands rise.

3. Missed deployment windows

Time decay also affects performance. When a fund misses its ideal entry point because commitments lag, that lost compounding window directly impacts IRR.

Missed windows can’t be recovered. They ripple through fund economics, diminishing carry potential years later. Allocators recognize this drag instinctively; all else equal, funds that execute closer to their intended deployment window tend to fare better on a time-adjusted basis.

Allocators review hundreds of decks each quarter. Under time pressure, they rely on cues such as clarity, consistency, and tone to infer operational capability.

In the language of signaling theory, design quality is a proxy for institutional readiness. When data tables are misaligned or track records lack standardization, some LPs may interpret that as chaos behind the curtain.

Common friction signals include:

Unstandardized track record tables that obscure comparability and invite doubt about accuracy.

Overwritten, text-heavy slides that suggest difficulty articulating an investment thesis concisely.

Inconsistent branding or structure that imply internal disorganization.

Each instance creates cognitive friction. Institutional allocators expect clarity because it signals control. Funds that force them to work harder are often cut early in screening. Presentation polish, when grounded in accurate data, becomes shorthand for credibility.

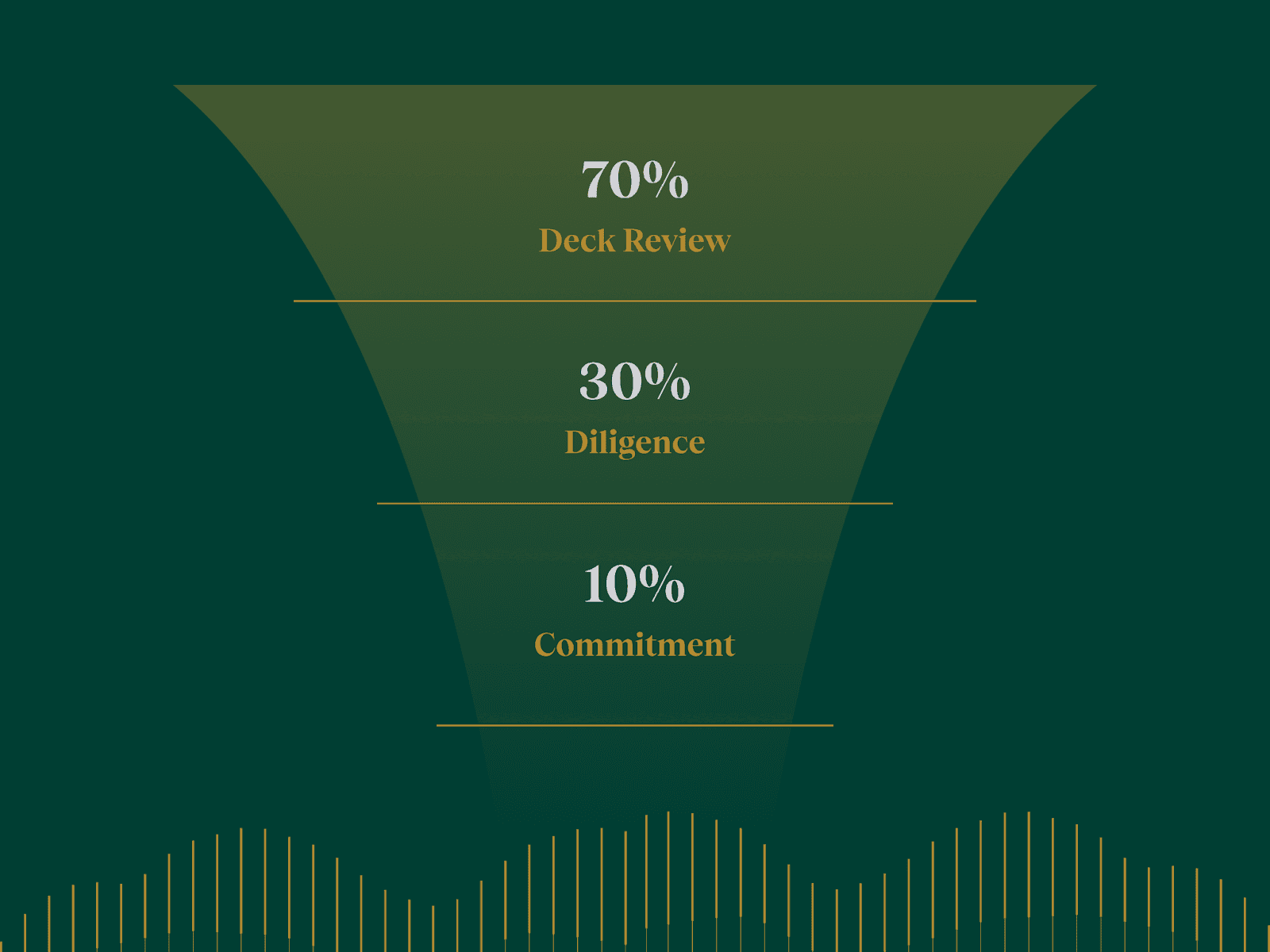

The first 2-5 minutes

Investors typically take two to five minutes to read a pitch deck before deciding whether to meet with a founder, and institutional allocators reviewing fund materials operate under even tighter constraints. When an LP screens 150-200 opportunities annually, those opening moments become decisive.

This time pressure creates a practical reality: your opening slides must do the heavy lifting. The first few slides are crucial for creating a good first impression, with many successful decks diving straight into the problem to give the audience a clear starting point. If those initial slides create confusion or require mental translation, the allocator's default assumption shifts from "tell me why yes" to "find reasons to decline."

LPs conduct rapid fit assessments based on mandate criteria and presentation quality during initial screening, ranking material quality and transparency among their top selection criteria. The front of your deck must immediately establish category positioning, articulate your investment edge with precision, and present quantified track record data in scannable format.

This explains why superficially similar funds often receive dramatically different allocator engagement levels. Two long-short equity managers with comparable returns may experience entirely different fundraising trajectories based solely on whether their opening slides establish immediate clarity or require interpretive work. In those critical first minutes, clarity converts.

The ROI of collateral quality

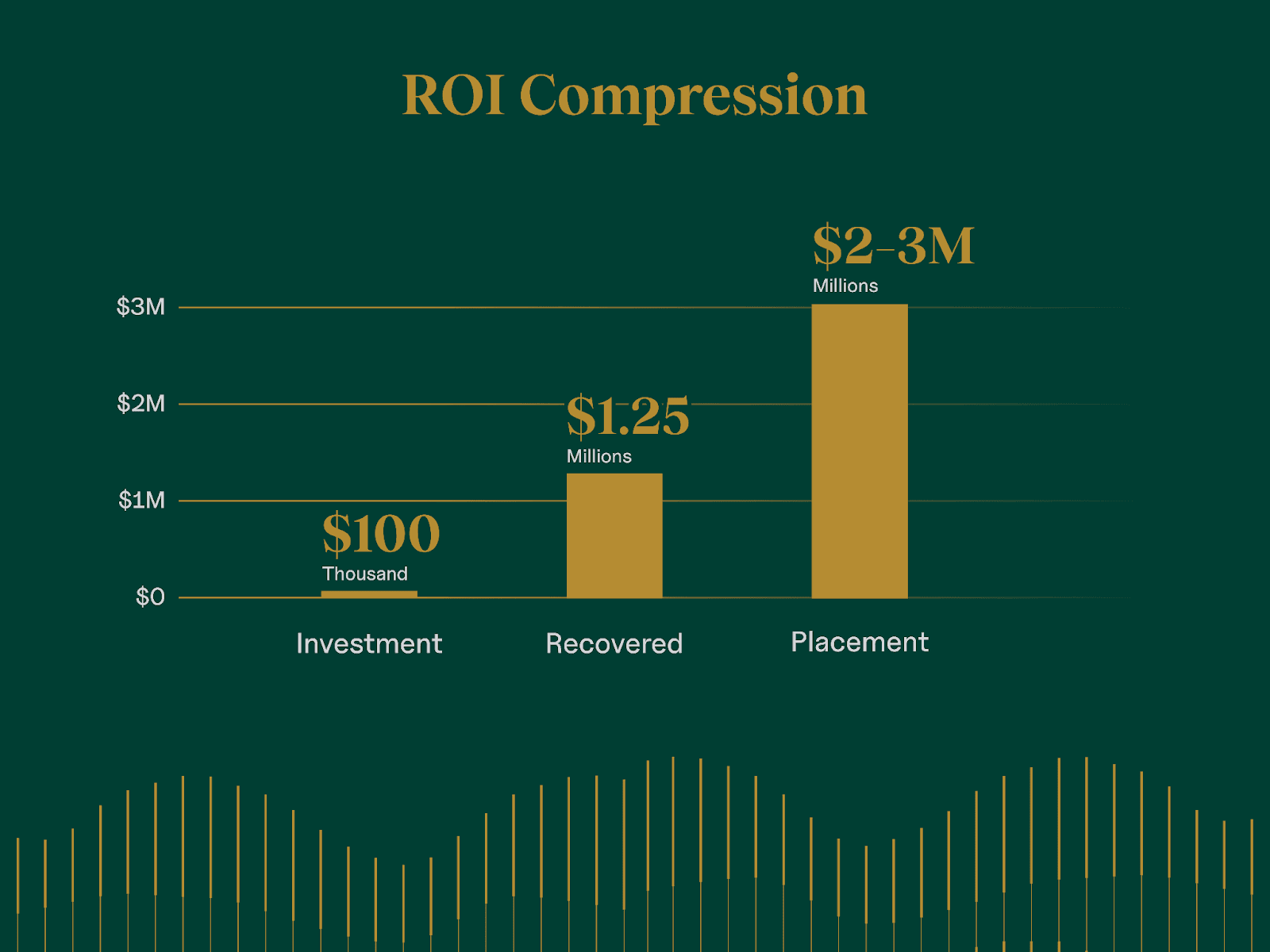

For GPs skeptical about the value of design, the math is compelling. Consider a mid-market private equity firm raising a $200 million Fund II.

Scenario A (weak collateral): 22-month raise, 150 hours of clarification calls, $1M in lost fees.

Scenario B (institutional collateral): 16-month raise after $100K invested in professional materials, 100 hours saved, $1.25M recovered in value. Compressing the cycle by six months through improved clarity and data standardization recovers more than $1.25 million in combined time and fee value. The investment in professional collateral pays for itself multiple times within the same raise.

Beyond quantifiable ROI, institutional-quality decks function as operational infrastructure. They centralize data, standardize metrics, and simplify the due diligence process. When core materials align with ILPA templates, responding to DDQs takes hours instead of days, freeing analysts and partners alike.

Standardization as operational leverage

Professional collateral creates benefits that extend far beyond a single fundraise. When a firm builds ILPA-aligned data architecture into its core materials, that standardization becomes reusable infrastructure for every subsequent capital conversation. The same data structures that power a pitch deck can directly populate quarterly investor letters, annual reports, and due diligence responses.

This infrastructure advantage manifests most clearly during DDQ response cycles. Institutional allocators increasingly require detailed operational due diligence questionnaires that can span 150 questions covering everything from cybersecurity protocols to ESG reporting frameworks. Firms with fragmented data systems where performance lives in one spreadsheet, portfolio details in another, and compliance documentation in a third, can spend a significant amount of time compiling responses.

By contrast, firms that built standardized data architecture when creating institutional collateral can respond much faster because information already exists in allocator-ready format. Over a fund's lifecycle, this efficiency advantage saves hundreds of hours of senior team time while reducing error rates and improving allocator confidence in data integrity.

The compounding benefit appears most dramatically during multi-fund raises. A manager launching Fund III with institutional-grade systems inherited from Fund II can redirect resources previously spent on materials development toward relationship building and differentiated content. The operational leverage increases with each fund generation, creating a widening gap between firms that invested in infrastructure early and those still assembling materials reactively for each raise.

When weak collateral leads to placement fees

One of the most expensive outcomes of poor communication is outsourcing it. Placement agents, while valuable for access, can often become a necessity because materials fail to resonate on their own. Standard fees typically range from 2–3% of total capital raised, which is $2–3 million on a $100 million fund.

Worse, heavy reliance on an intermediary can inadvertently signal weakness. Some sophisticated LPs sometimes interpret agent dependence as a potential indicator that the GP has not yet established fundraising strength or direct credibility with the allocator community or fundraising strength. In contrast, clear, allocator-ready materials demonstrate command of the story and confidence in execution. Investing in collateral can eliminate the need for costly representation altogether.

Spending $100K on materials beats paying $2–3M in placement fees, it’s 20x cheaper and you keep control of your fundraise.

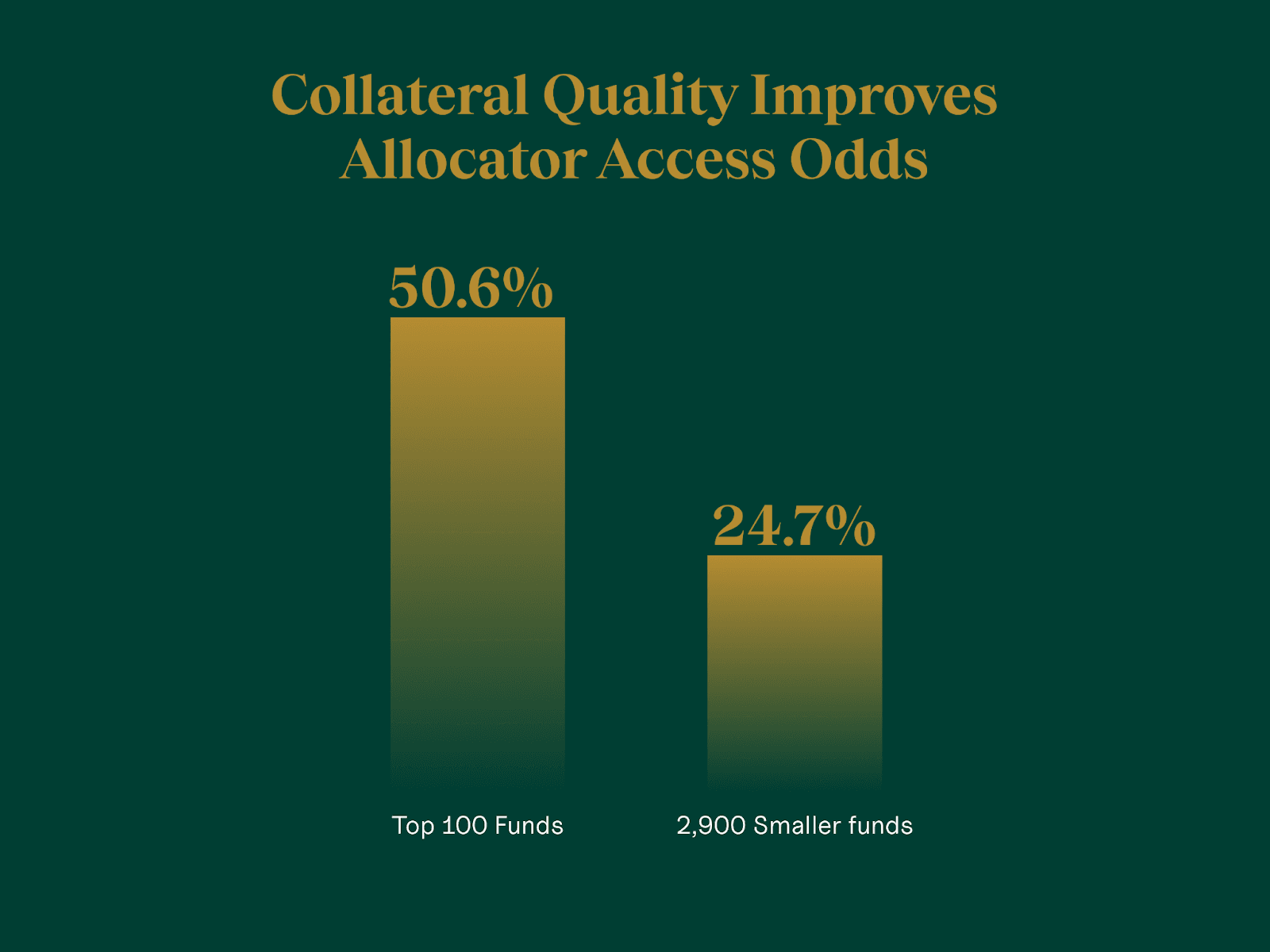

The credibility tax on emerging managers

Established funds can sometimes rely on reputation to offset ok decks. Emerging managers can’t. Consolidation is accelerating: in 2024, 50.6% of all commitments went to the 100 largest funds, while 2,900 smaller managers split just 24.7% (PitchBook Fundraising Data, 2024). For smaller firms, presentation quality becomes a decisive differentiator.

Allocators evaluating new or niche managers are hypersensitive to perceived risk. Weak materials amplify those concerns. Conversely, when a first-time GP presents institutional-grade decks that are clear, consistent, and data-rich, it creates a reverse signal: “This team operates above its weight.”

That early perception can determine whether the GP makes it past screening. Collateral can’t replace a track record, but it can accelerate trust.

The full collateral ecosystem

Fundraising isn’t a single presentation; it’s an ecosystem. Allocators experience your brand through a chain of materials: teaser, pitch deck, fact sheet, DDQ, and quarterly updates. Inconsistency anywhere in that chain raises questions about process quality everywhere.

Common breakdowns include:

A teaser promising clarity but a deck that confuses.

Quarterly reports that reformat data inconsistently, forcing LPs to reconcile figures.

Brand and messaging mismatches that make the organization look fragmented.

Institutional allocators benchmark these materials subconsciously against global peers. A presentation that would impress in a founder pitch feels amateurish when compared with what top-quartile funds deliver daily.

Consistent collateral creates coherence. It signals reliability, readiness, and respect for allocator time. Weak materials, by contrast, erode internal champions (those LPs who want to advocate for your fund but can’t because your materials don’t support their case internally).

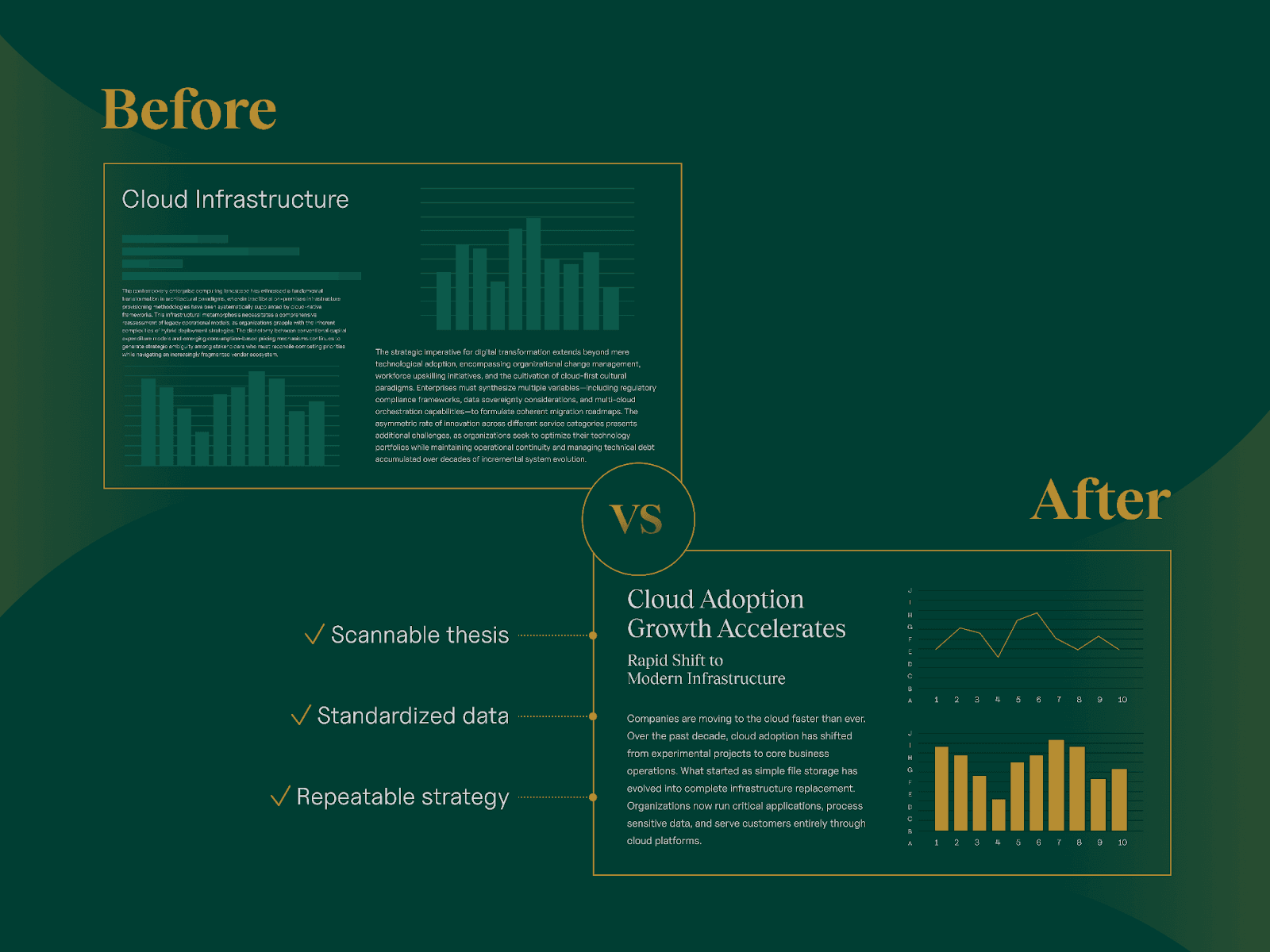

What institutional quality actually means

“Institutional quality” isn’t code for expensive design. It means structure, clarity, and repeatability. Your content should answer the benchmark question: Would this deck look credible in a Fortune 500 boardroom?

An institutional-grade deck delivers three functional outcomes:

Scannable thesis – A reviewer can grasp the core strategy in under 90 seconds.

Standardized data – Track records are directly comparable and sourced.

Repeatable narrative – An allocator can retell the thesis accurately without the GP present.

This clarity doesn’t just impress, it scales. When data is structured consistently, future fund materials evolve faster, saving design and analyst time across fund cycles.

Segment-specific nuance in collateral expectations

While institutional quality follows universal principles, the benchmarks vary subtly by asset class.

Real estate funds are judged heavily on transparency at the deal level. Allocators expect clear tables linking project IRRs to realized exits and geographic or sector positioning.

Hedge funds, by contrast, must communicate a repeatable edge through risk-adjusted metrics, drawdown history, and liquidity management clarity.

For private equity or growth funds, narrative precision around sourcing, value-creation levers, and portfolio attribution analysis carries more weight than design flair.

Recognizing these distinctions demonstrates operational maturity and helps each manager speak the allocator’s language in their specific segment.

The bottom line

Weak materials quietly tax every raise. Each delayed month drains fees, credibility, and momentum. Investing in institutional-grade collateral is part of your core operational strategy. Every slide either compounds or compresses your cost of capital. The smartest managers choose compression.

Frequently Asked Questions