Learn what a pitch deck is, what it looks like, and why finance-sector firms should partner with specialized experts to craft investor-ready presentations.

Dec 4, 2025, 12:00 AM

Written by:

Niko Ludwig

Table of Contents

Key Takeaways:

Pitch decks are strategic narratives, not design files. They combine story, data, and positioning to help financial firms communicate value with clarity and authority. A good deck aligns every slide to a single message: why your firm deserves attention.

Design reinforces credibility in finance. Clean layouts, muted palettes, and data led visuals shape investor perception before a single word is read. In institutional contexts, design is a trust signal.

Data only works when tied to a story. Metrics need narrative context to matter. Investors respond best when numbers support a clear “why now” and “why us”.

Whether you lead a wealth-management boutique, a financial-advisory firm, or a venture-backed fintech, one document stands between you and your next opportunity: the pitch deck.

But what is a pitch deck exactly? And why does it matter so much in finance and investment? In this guide, we’ll break down what pitch decks are, what they look like, and which components make them work—not just for startups chasing VC funding, but for established financial firms positioning for growth, partnerships, or acquisitions.

A pitch deck is a concise presentation (usually 10 to 15 slides) that summarizes a company’s story, strategy, and opportunity.

Traditionally used by startups to secure venture capital, pitch decks have become a universal communication tool for founders, CMOs, and financial executives who need to align investors, partners, and internal stakeholders.

For financial-sector firms, pitch decks are far more than fundraising assets. They are:

Trust-building tools for investors, board members, or high-net-worth clients.

Strategic narratives that clarify your business model, market positioning, and regulatory readiness.

Sales enablers that help advisory or fintech teams present complex value propositions in simple, credible terms.

In short, your pitch deck is a visual summary of your firm’s intelligence and intent.

A pitch deck is not a dense report, rather it visually resembles a clean, minimalist presentation. The best decks combine:

Professional design (muted palette, legible fonts, consistent branding).

Data-driven visuals (charts, growth metrics, client segments).

Compelling storytelling (a logical narrative flow from problem to opportunity to solution, growth, and ask).

For finance-sector firms, where credibility and compliance are paramount, decks often feature visualized data (AUM growth, market opportunity, advisor-network diagrams) rather than flashy startup graphics.

A strong pitch deck presentation should feel trustworthy, intelligent, and investor-ready. Think less “startup hype” and more “institutional confidence.”

What is a pitch deck presentation used for?

While many people associate pitch decks with raising capital, in the finance and wealth space, they serve broader purposes:

Investor or partner pitches: presenting to private-equity, venture, or institutional partners.

Board or stakeholder updates: communicating performance and strategic pivots.

Strategic partnerships: introducing your firm’s capabilities to fintech platforms, banks, or family offices.

Client acquisition: explaining your advisory process and differentiation.

Internal alignment: rallying leadership around growth targets and marketing investment.

What are the 3 most important components of a pitch deck?

Across industries, three elements define an effective deck:

A clear narrative. The story of the problem, your solution, and the market opportunity.

Data-driven proof. Traction metrics, client growth, and credible financials.

A strategic ask. The investment, partnership, or engagement you’re inviting.

Together, these form the story-proof-ask framework of every persuasive pitch deck.

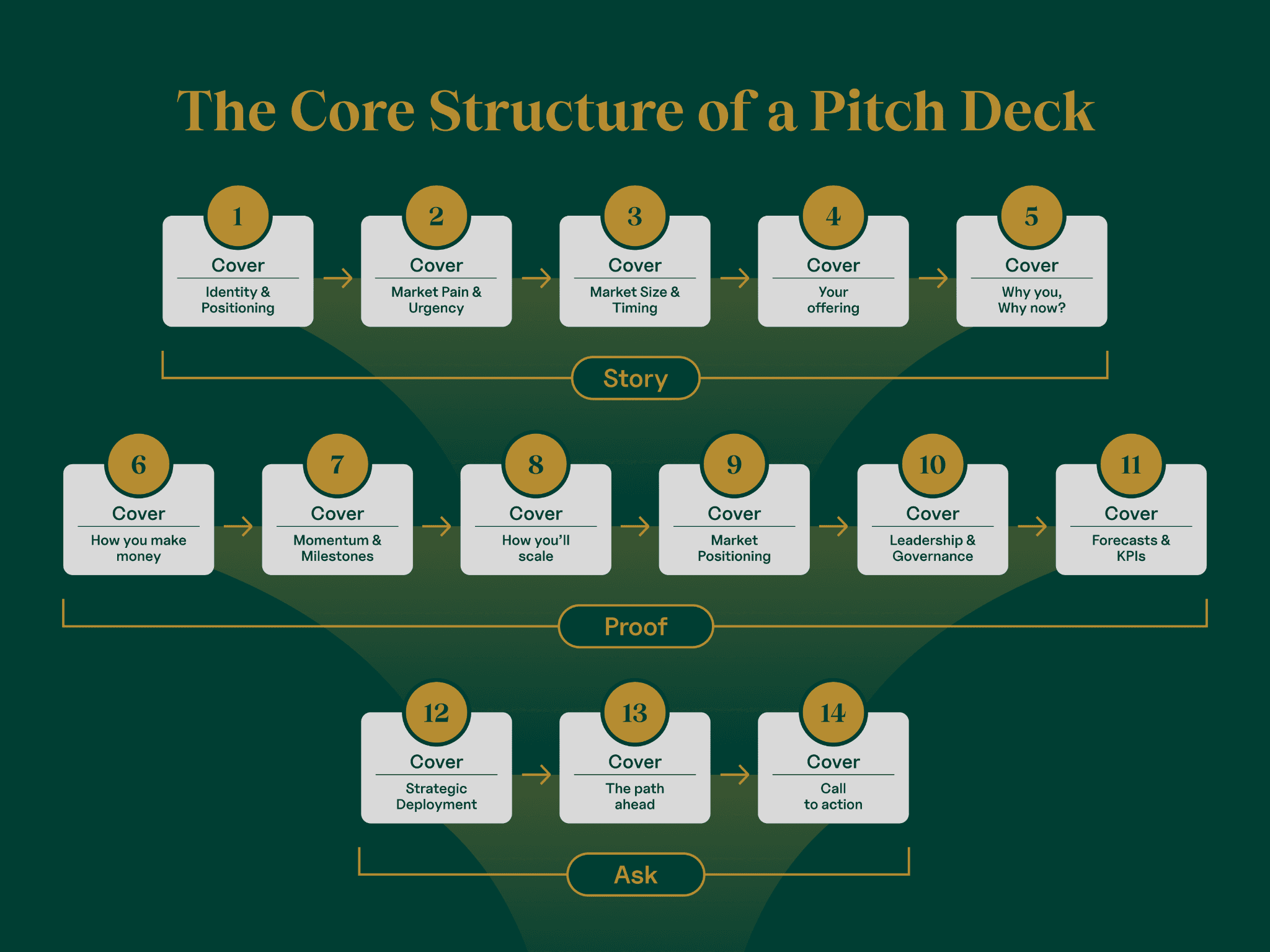

The core structure of a pitch deck (slide by slide)

Cover slide – identity and positioning

Lead with your firm’s name, logo, and tagline. Add a succinct positioning statement that encapsulates your value. Keep it clean and professional as your cover sets the tone for trust and design quality.

2. Problem slide – market pain and urgency

Define the problem you’re solving in the market. Anchor it in real data or trends, showing why this moment demands your solution. For finance, this could be:

Inefficient legacy platforms.

High client acquisition costs.

Evolving investor expectations for digital engagement.

3. Opportunity slide – market size and timing

Quantify the opportunity with metrics like TAM/SAM/SOM, industry growth rates, or shifting demographics. Investors want to see both scale and urgency: that the market is big, accessible, and ready for something new. For example: “The digital wealth management market is projected to reach $2.5T AUM by 2027.”

4. Solution slide – your offering

Explain how your firm or platform solves the defined problem. Focus on outcomes, not just features. This is where clarity and simplicity matter most.

5. Value proposition – why you’re different

Answer the question: Why you, and why now? Your value proposition slide should distill your firm’s “edge” into one visual idea. Differentiate on dimensions like proprietary technology or process, regulatory readiness, brand trust, and leadership experience.

6. Business model – how you make money

Summarize revenue sources (AUM-based fees, SaaS subscriptions, performance-based incentives, advisory retainers). Include margin trends or scalability factors. Show that you understand financial sustainability, not just growth.

7. Traction slide – momentum and milestones

Graphs or timelines work better than text. Momentum builds credibility. Showcase proof of success:

Client or user growth

Partnerships secured

Key milestones achieved (licenses, integrations, funding rounds)

8. Go-to-market strategy – how you’ll scale

Outline your distribution and acquisition plans. Investors want to see how traction converts into long-term market share. In finance, this may include:

Strategic alliances with broker-dealers or banks.

Advisor recruitment models.

Digital marketing and referral funnels.

9. Competitive landscape – market positioning

Use a simple visual (2x2 matrix or comparison grid) to illustrate where you fit among incumbents and competitors. Highlight differentiation without disparaging competitors and focus on why your approach scales more efficiently or ethically.

10. Team – leadership and governance

Investors back people first. Highlight founders and executives with relevant domain expertise: compliance, operations, product, marketing, and finance. If you have notable board advisors or regulatory specialists, this is the place to introduce them.

11. Financials – forecasts and KPIs

Summarize projections over 3–5 years. Include:

Revenue growth

Key ratios (CAC, LTV, margins)

AUM or client growth trajectories

Show assumptions but do it transparently; realism is more persuasive than optimism.

12. Use of funds – strategic deployment

If raising capital, specify how funds will be allocated: e.g.:

40% tech development

30% marketing and advisor recruitment

20% compliance infrastructure

13. Roadmap – the path ahead

Provide a timeline of upcoming goals: product releases, regional expansion, new partnerships. This slide shows planning maturity and a long-term view.

14. Closing slide – CTA

End with clarity. Invite the next step: a meeting, demo, or partnership call. Include concise contact info and, ideally, a memorable closing statement or brand line.

Common mistakes in pitch decks (especially in finance)

The number of slides you create or the amount of information you provide is not as important as how your pitch deck cohesively tells your story.

Too much data, not enough narrative

Finance leaders often feel compelled to prove expertise by adding every data point, ratio, or benchmark. Yet, unstructured data overwhelms audiences and might even jeopardize your message. Instead, start with an insight, then support it with a single, clear chart or number that reinforces your point. Let the story drive the data, not the other way around.

Ignoring compliance and risk

Investors in finance expect a clear acknowledgment of regulatory awareness. A missing compliance slide can raise red flags. Include a concise view of your governance model, licenses, or risk-management framework. This reassures investors that your growth is sustainable and legally sound.

Generic visuals

Many firms borrow generic startup templates with bright gradients or cartoon icons, which usually undermines credibility. Make sure to use muted, sophisticated palettes (navy, slate, silver), clean typography, and minimalist design.

Unclear or missing ask

Ending your presentation with “Thank you” but no next step confuses the audience. Your deck should clearly articulate what you want and why: the amount of investment, type of partnership, or next meeting objective. Specificity translates into confidence.

Advanced elements for finance and wealth firms

To stand out in a sophisticated investment environment, finance and wealth firms must go beyond the basics. These four advanced elements help your pitch deck convey both innovation and institutional readiness.

1. Regulatory readiness

Regulation is an essential part of your competitive advantage. Show that your firm has anticipated compliance requirements and integrated them into your strategy. This might include:

SEC or FINRA registration details.

AML/KYC processes.

Advisory board or legal counsel profiles.

2. Technology enablement

Investors expect efficiency and scalability powered by technology. Demonstrate how your tech stack (CRM automation, client portals, or AI-driven insights) transforms cost structure or client experience. Include metrics such as reduced onboarding time, digital adoption rates, or client satisfaction improvements to substantiate your claim.

3. ESG and impact narrative

Environmental, social, and governance (ESG) standards now shape investor priorities. PitchBook's 2025 Sustainable Investment Survey reports that 72% of investors incorporate ESG factors into their evaluation process, with sustainable assets under management projected to exceed $40 trillion by 2030.

Briefly show how your firm integrates responsible investment principles, diversity initiatives, or sustainable practices. Even small commitments (e.g., transparent fee models or community investment programs) can strengthen your narrative and appeal to institutional backers.

4. Distribution and advisor network strategy

Growth often depends on relationships. Illustrate how your distribution ecosystem works: independent advisors, referral partners, institutional alliances, or digital marketing funnels. Visualize this with a simple diagram or flow that illustrates the journey from brand to advisors to

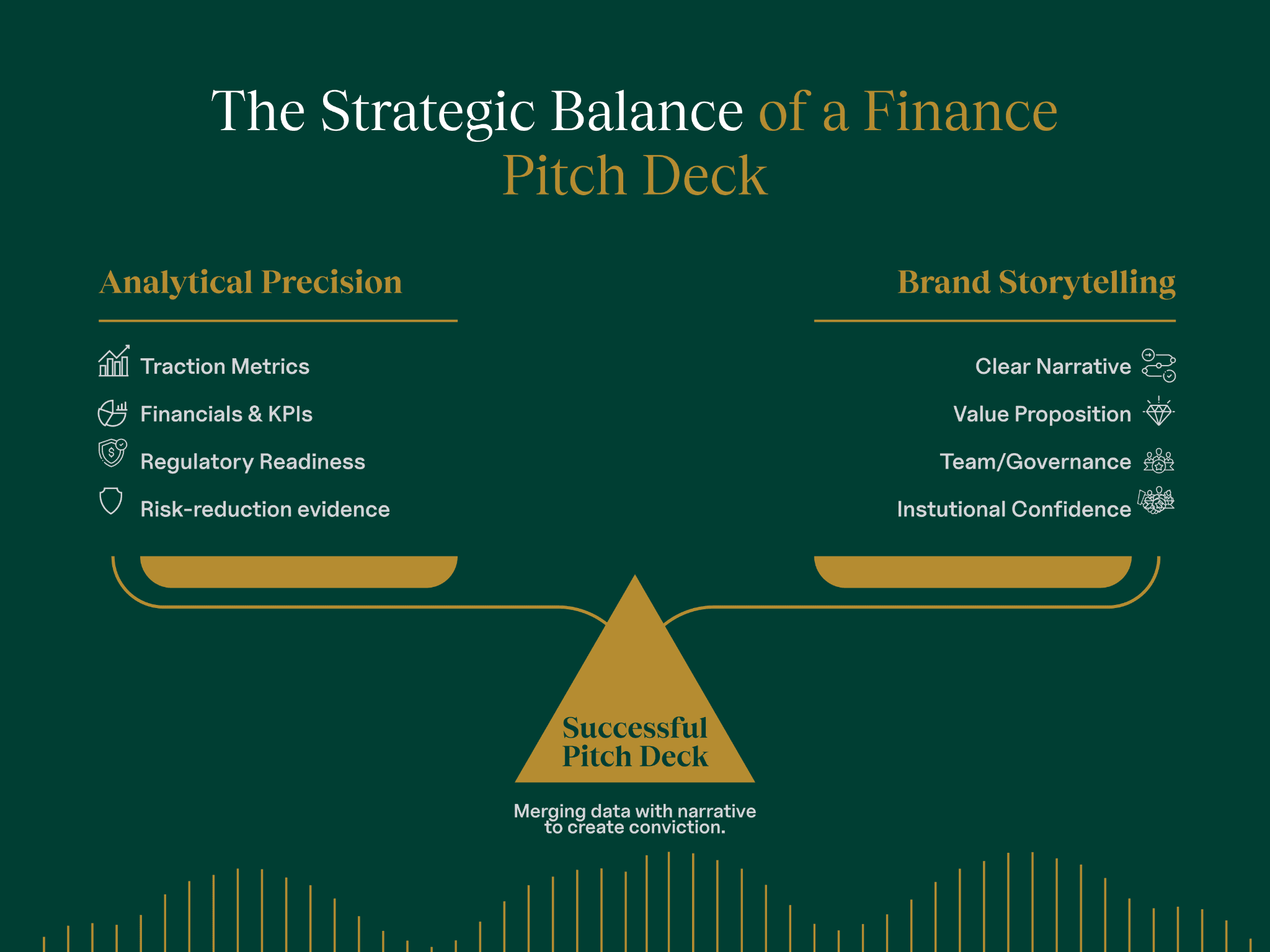

What is the key to a successfull pitch deck?

The strongest decks don’t just inform, they influence. They merge analytical precision with brand storytelling to create conviction in the room.

Storytelling

Numbers matter, but emotion drives decisions. Weave a concise story around why your firm exists, what problem it solves, and the real-world change it enables. This is where brand narrative meets investor logic, creating a balance of human impact and measurable progress.

Risk-reduction evidence

Institutional and private investors assess opportunity through risk. Use metrics, regulatory compliance, and partnerships as risk-reduction proof points. Highlight traction: not just revenue, but efficiency, governance, and client retention. The more predictable your model looks, the more fundable it becomes.

CB Insights research shows that 29% of startups fail due to running out of cash, often because financial projections were too optimistic or failed to account for real-world market conditions. Sophisticated risk analysis and realistic financial modeling strengthen investor confidence

Design reinforcing credibility

A visually consistent deck conveys stability, precision, and control, values that are critical in finance. Make sure to use brand-aligned spacing, typography, and restrained color to create visual confidence without distraction.

Clarity about what success and partnership look like

End with a forward-looking statement: what success means for both sides. Whether it’s expanding AUM, co-developing a product, or entering new markets, define what partnership looks like. It shifts the conversation from “Do we invest?” to “How do we partner?”, a subtle but powerful reframing.

For CMOs and founders, a successful pitch deck isn’t just an investor presentation, it’s a strategic marketing asset that crystallizes vision, validates performance, and aligns stakeholders under a unified growth story.

Why you need a specialized partner to build your pitch deck

Crafting a persuasive pitch deck requires more than financial expertise, and this is where specialized partners add real value.

Partnering with a specialized financial-marketing agency bridges that gap by translating complex financial concepts, data, and compliance nuances into a clear narrative. These experts understand the visual language of trust (muted tones, structured layouts, and data-driven storytelling), ensuring that your deck resonates with both institutional and venture audiences while reflecting the credibility expected in the finance sector.

Beyond design, a specialized partner aligns your deck with your broader brand and growth strategy, creating cohesion across investor materials, digital channels, and board communications. They save leadership time, accelerate delivery, and bring cross-industry insight from hundreds of investor interactions refining your message, visuals, and confidence.

Bottom line

A well built pitch deck is a strategic communication tool that shapes how investors, partners, and clients understand your firm. It signals confidence through design, clarity through structure, and conviction through a focused narrative. In finance, this combination becomes a competitive advantage that influences the room before the conversation even begins.

Great decks move beyond information and create alignment around a firm’s vision, performance, and future direction. They show discipline in how data is presented and intention in how the story unfolds. When executed well, a pitch deck becomes a foundation for trust that supports every investor discussion that follows.

Frequently Asked Questions