Learn why simplicity is one of the strongest signals managers can send to institutional allocators. And why clear communication improves understanding, speeds due diligence, and strengthens long term investor relationships.

Nov 27, 2025, 12:00 AM

Written by:

Niko Ludwig

Table of Contents

Key Takeaways:

Clarity signals competence. Simplicity is the ultimate signal of deep understanding. Investors choose managers who can make complexity clear, as this demonstrates genuine mastery.

Trust is built on cognitive fluency. The human brain is wired to trust information that is easy to process. Cognitive ease is a critical sorting mechanism for allocators, making clear communication a powerful competitive advantage.

Complexity is a strategic liability. Unnecessary intricacy in communication is often interpreted by allocators as strategic confusion or a deliberate attempt to mask weaknesses.

A pension fund allocator sits across from two private equity managers. The first presents a 120-page deck filled with elaborate diagrams, multi-layered structures, and technical jargon. The second hands over 15 pages with clear narratives, straightforward frameworks, and plain language. Both have solid track records.

Which manager gets the allocation? Most investors pick the second. Not because they can't handle complexity, but because clarity signals something complexity can't fake: genuine mastery.

Your brain makes snap judgments about credibility. Research on cognitive fluency shows that information requiring less mental effort to process feels more true, more credible, and more trustworthy. This isn't intellectual laziness. It's how human cognition works.

Daniel Kahneman's work on cognitive ease demonstrates that when our brains encounter material that flows smoothly, we experience positive affect and increased confidence in the content. The opposite happens with intricacy. Difficult-to-process information triggers doubt, even when the underlying quality is identical.

Adam Alter and Daniel Oppenheimer conducted studies showing that identical investment advice presented in complex language was rated less credible than the same advice in plain language. Fonts matter too. Research published in Psychological Science found that hard-to-read fonts decreased trust in financial statements, even when the numbers were the same.

For institutional investors reviewing 50-100 manager presentations per quarter, this creates a powerful sorting mechanism. Research from DocSend shows investors spend less than 4 minutes reviewing pitch materials, making cognitive ease a critical filtering mechanism.

Clear communication breaks through. Intricacy creates friction. The insight isn't that simple ideas perform better, but that simple expression of multi-layered ideas signals competence. A manager who can distill a multi-strategy approach into three clear principles demonstrates deeper understanding than one who needs 40 slides to explain the same thing.

The risks behind complex communication

Too many details in manager communication often serves as camouflage. If a strategy takes multiple diagrams or heavy terminology to explain, most allocators will find it hard to follow. And when a thesis needs a glossary, it usually means the team hasn’t reduced the idea to something others can understand easily.

Three patterns emerge repeatedly:

First, unclear thinking masked as sophistication. A mid-market buyout fund described their strategy using terms like "synergistic value creation through operational leverage and strategic repositioning." Pressed for specifics, they couldn't articulate which operations they'd improve or why. The jargon concealed the absence of a real thesis.

Second, information asymmetry by design. Intricate documentation creates knowledge gaps that favor the manager. If you can't readily understand the fee structure, the waterfall, or the investment process, you can't evaluate them properly. Some managers prefer it that way.

Third, cognitive overload that hides weaknesses. When a risk framework becomes too dense, even strong teams struggle to identify their top priorities. If a model spans dozens of variables and multiple categories, but the team cannot point to the few risks that drive their decisions, the complexity becomes a distraction rather than a tool.

Warren Buffett’s principle applies directly to fundraising: allocators interpret communication complexity as strategic confusion. Every unclear pitch deck becomes a data point against you in their evaluation rubric.

The data supports brevity. Research analyzing successful fundraising campaigns found that pitch decks with 11-20 slides have 43% higher success rates than longer presentations. The constraint forces discipline: every slide must justify its inclusion, and every point must matter.

What is simple communication?

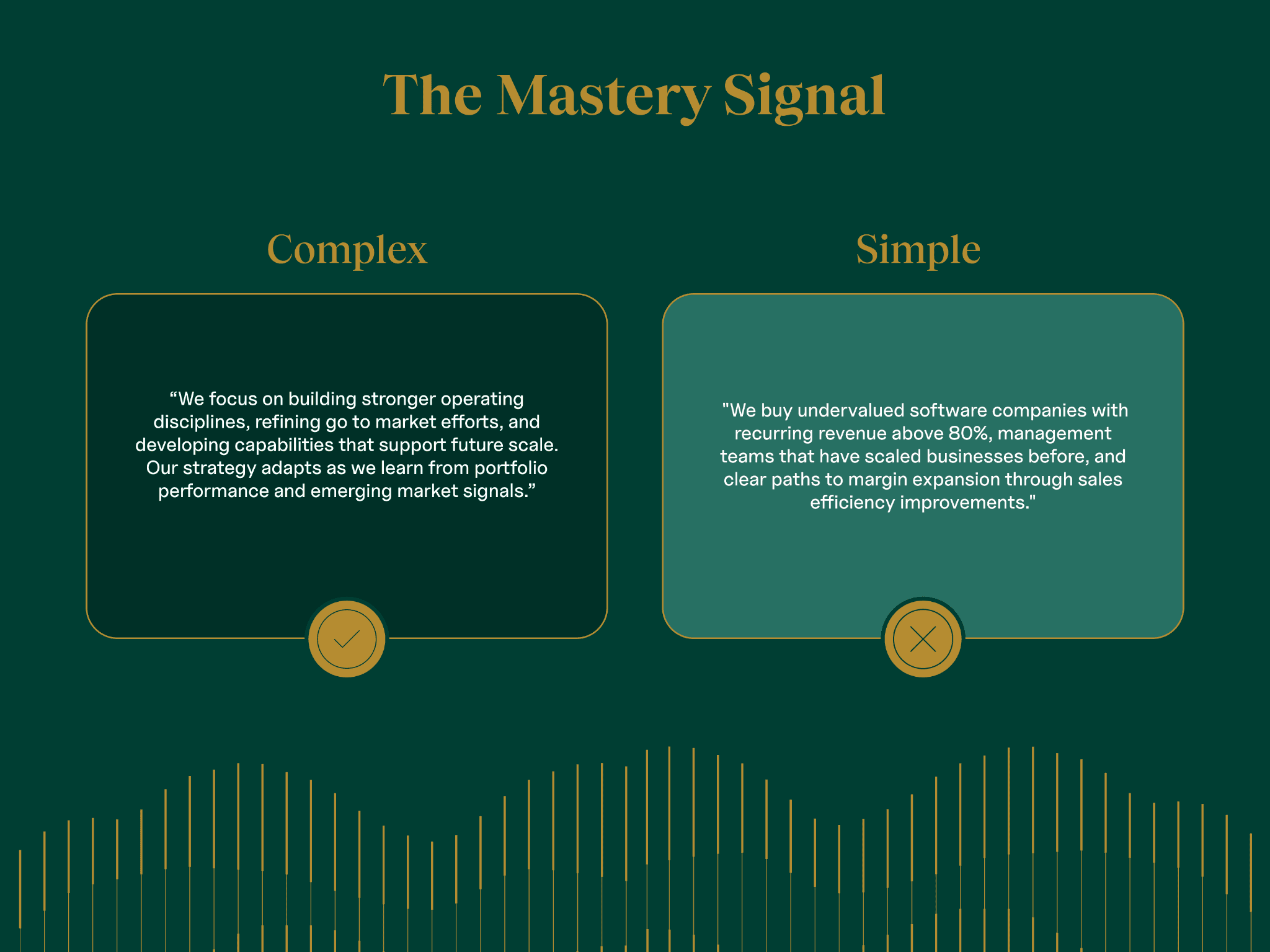

Simplicity is not the same as simplisticness. There's a crucial difference. Simple: "We buy undervalued software companies with recurring revenue above 80%, management teams that have scaled businesses before, and clear paths to margin expansion through sales efficiency improvements."

Simplistic: "We buy good companies cheap." The first statement is specific, falsifiable, and actionable. The second is generic and meaningless. Simplicity requires precision. It forces you to commit to clear claims that can be evaluated.

Four steps make it work:

Understanding first principles clearly enough to separate what matters from what doesn’t. Strong communicators reduce their strategy to its essential drivers. They can explain the core thesis in a few clear statements because they’ve done the analytical work required to know what truly moves returns.

Discipline to say what matters most. Every strategy has dozens of inputs, but not all of them deserve equal attention. Effective managers identify the handful of factors that drive outcomes and focus their communication around those points instead of drowning allocators in detail.

Confidence to be judged on clear claims. Vague language creates room for interpretation. Clear statements create accountability. Teams that communicate simply show that they are confident in their framework and comfortable being evaluated on it.

Respect for the audience’s time and intelligence. Institutional allocators do not need exhaustive detail to feel informed. They need concise, straightforward explanations that let them understand the strategy quickly and ask better questions.

Howard Marks' market memos demonstrate this mastery. He discusses intricate market dynamics, behavioral finance, and risk assessment using language accessible to any educated reader. Ray Dalio's "Principles" explains a 120-factor economic model through clear analogies. Berkshire Hathaway's annual letters cover acquisitions, insurance float, and capital allocation without jargon.

These aren't dumbed-down versions. They're expert communication of expert thinking.

The performance impact of clear communication

Clear communication supports better decision-making and stronger allocator engagement. This connection runs through multiple channels.

Research backs this up. A 2024 CoreData survey of 132 institutional investors managing 4.9 trillion dollars found that 59 percent say the quality of market commentary and thought leadership directly influences their likelihood of investing with one manager over another. Clarity matters: 82% report that high quality thought leadership increases their engagement with asset managers, and nearly half say it helps them understand complex market trends more effectively.

Faster feedback loops follow. When your thesis is clearly stated, you can evaluate whether reality matches expectations more quickly. A distressed debt fund with a muddled strategy takes longer to recognize when market conditions have shifted. Clear frameworks enable rapid course correction.

Investor partnerships matter too. Limited partners who genuinely understand a manager's strategy behave differently during volatility. They don't panic when drawdowns occur within the stated risk parameters. They ask better questions. They can be genuine thought partners rather than nervous capital sources.

The compound effect builds over time: Straightforward communication creates trust, trust enables patience, patience allows strategies to play out properly, which leads to better long-term outcomes.

Risk management provides the strongest link. You can't effectively manage risks you can't clearly articulate. A multi-strategy hedge fund described their risk framework in eight dense pages of technical terminology. When markets dislocated, their risk systems failed because no one on the team shared a common understanding of what they were monitoring. A clearly articulated risk framework serves both communication and operational infrastructure.

When complexity is legitimate

Not all complexity signals confusion. Some investment strategies are inherently intricate, and attempts to oversimplify them create more problems than they solve. Certain derivatives strategies require technical precision that plain language can't capture.

For example, a fund executing multi-leg options strategies across volatility surfaces needs specific terminology to communicate risk parameters accurately. Eliminating technical language would sacrifice accuracy for accessibility, helping no one.

Regulatory requirements often mandate complexity. UCITS documentation, SEC filings, and cross-border fund structures involve legal specifications that can't be simplified without compromising compliance. When a fund operates across multiple jurisdictions with different regulatory frameworks, the documentation reflects that reality.

Even with legitimate clarity, communication alone doesn't guarantee investment success. Strong fundamentals, team quality, and market timing matter more than presentation polish. Clarity is a necessary condition for trust, not a sufficient condition for returns.

Emerging market investments with unique local structures legitimately require more explanation. A fund investing in Chinese variable interest entities or Middle Eastern sukuk structures must educate investors on legal mechanisms unfamiliar to Western allocators. That's educational complexity, not obfuscation.

Necessary complexity serves investor understanding. Unnecessary complexity serves manager interests. Strong managers know the difference and communicate accordingly. They provide technical detail when precision demands it, but never use complexity as a substitute for clear strategic thinking.

Once you’ve distinguished necessary from unnecessary complexity, the next step is understanding how investors evaluate your communication itself, and what those assessments mean for your fundraising process.

How allocators evaluate manager communication

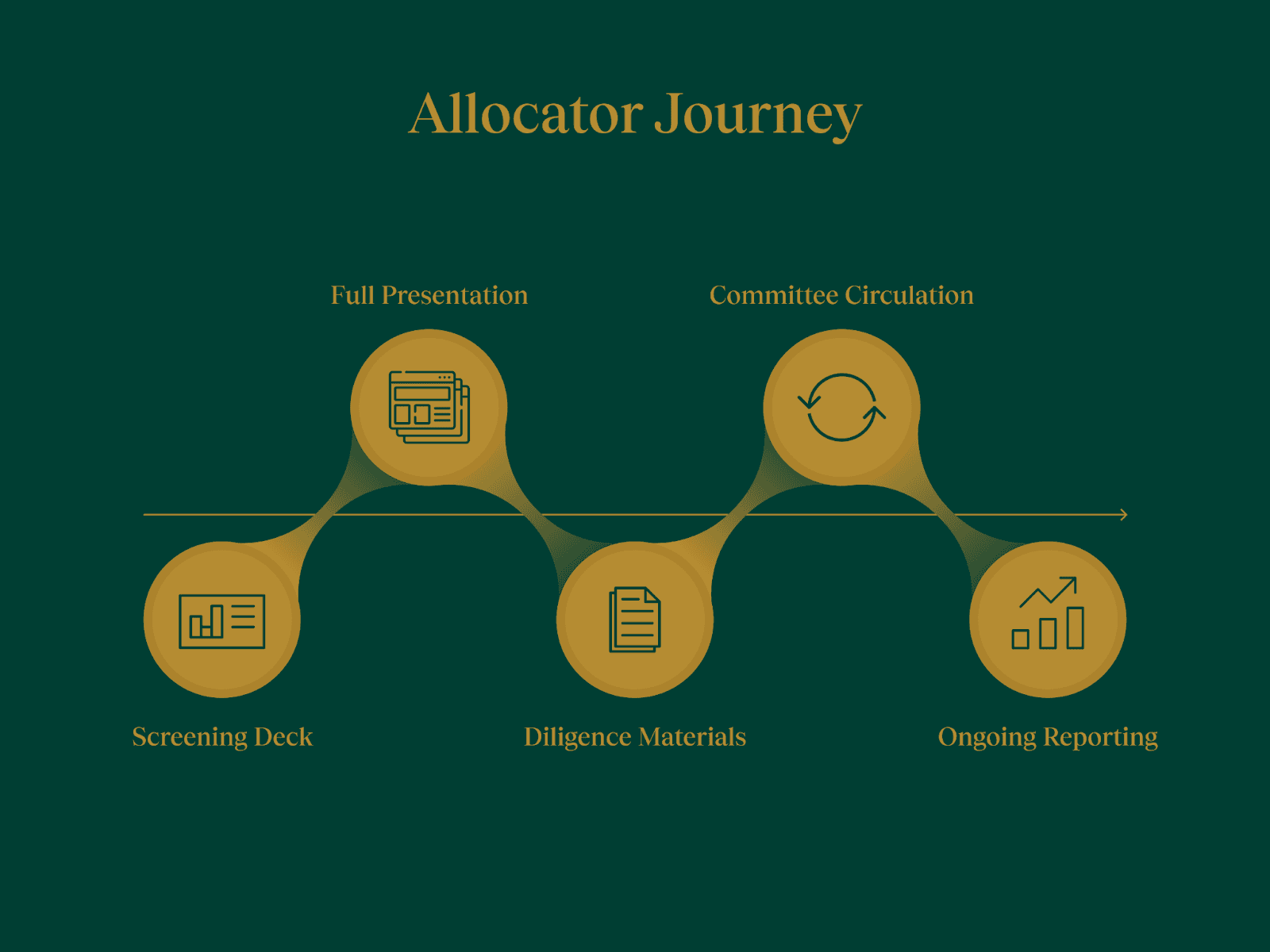

The stakes are measurable. Research from Institutional Investor's Custom Research Lab found that 50% of clients rate a manager's proposed strategy and process for working together as extremely important in their selection decision. Clear communication of that process matters as much as the strategy itself.

Red flags that cost you allocations:

If you can't explain your strategy in under three minutes, then it’s not clear

Different team members describe the thesis differently.

Documentation requires multiple reads to understand.

Complexity increases when asked probing questions.

Jargon appears where plain language would work.

Green flags that indicate communication mastery:

You can explain complicated thesis simply without losing nuance.

Writing is clear and accessible across all materials.

Your team has a unified, consistent narrative.

You proactively simplify dense topics.

Analogies and examples come readily.

The competitive advantage of clear communication

Fund managers competing for allocations should view transparent communication as a strategic differentiator, not soft skill. The competitive advantages compound quickly. In a market where hundreds of managers chase the same institutional allocators

Allocators track communication quality systematically. More than half (56%) of institutional investors actively review managers' past communications to assess accuracy and insight quality, using clarity as a predictor of future performance. Your communication history becomes part of your track record.

Sophisticated investors actively seek transparency. Contrary to the belief that institutional allocators prefer dense or highly technical presentations, most value managers who communicate clearly. They make multiple allocation decisions under time pressure, and clear content speeds their process.

Internal alignment strengthens when teams can articulate their strategy clearly. A private equity firm that can't explain their value-creation playbook simply probably hasn't fully developed it. The discipline of clear expression forces teams to resolve internal disagreements and establish shared frameworks.

Due diligence timelines compress significantly. Allocators complete reviews faster when documentation is clear. Fewer follow-up questions, fewer clarification calls, faster movement to final investment committees. This matters in competitive fundraising situations where speed wins.

LP relationships deepen through understanding. Limited partners who genuinely grasp your strategy provide better feedback, make better co-investment decisions, and commit to longer partnerships. Information asymmetry might feel like protection, but it undermines relationship quality.

The bottom line

Simplicity is a selection criterion, not a nicety. Your competitors are being evaluated by the same allocators reviewing your materials. When allocators process 50-100 decks per quarter, communication clarity becomes the first filter. Master it, and you advance to diligence. If you can master distilling complexity into clarity, you will demonstrate deep understanding, disciplined thinking, and respect for investors' time. These qualities will pay off in favorable decisions, lasting trust and more durable partnerships.

Frequently Asked Questions